The Compensation Committee presents the proposed Directors’ Compensation Policy for 2017-2019. It is the intention of the committee that this policy will be maintained for three years from approval, assuming no changes are required. The committee believes that this policy continues to align with the Company’s mission statement and business objectives as well as being competitive for current and successor Executive Directors.

Proposed policy changes

The 2017 policy that is being presented to share owners for approval has been drafted to take into account the views of our share owners that have been received over the last policy period. The key changes from the 2014 policy, which are described in the chairman’s letter, can be summarised as follows:

- The maximum annual bonus opportunity of the Group chief executive is reduced to 400% and for the Group chief financial officer to 250%. A minimum of 40% of the achieved bonus will be delivered in deferred shares (ESA).

- The maximum annual Executive Performance Share Plan (EPSP) opportunity of the Group chief executive is being reduced to 600% of base salary and for the Group chief financial officer to 300% of base salary. The EPSP plan will continue to operate over a five-year performance period and the performance measures of TSR, EPS and ROE remain unchanged.

- The threshold vesting level of the EPSP award is being reduced to 15%.

- The maximum level of annual pension contribution for the Group chief executive is being reduced to 30% of base salary.

- The Executive Directors will be provided with a non-itemised fixed benefits allowance to enable them to procure benefits to enable them to undertake their role and ensure their security and wellbeing. The benefits allowance for the Group chief executive will be £200,000 and for the Group chief financial officer $85,000 per annum.

- The maximum incentive award, the combination of short- and long-term incentives, for a new appointee to the Board, is being reduced to 8 times base salary.

- The maximum pension contribution for a new appointee to the Board is being reduced to 25% of base salary. This amount may be delivered by either a contribution towards a defined contribution retirement plan or by way of a cash retirement allowance.

The above proposed changes to policy will be effective 1 January 2017, except for the pension contribution which will be effective 1 July 2017. The impact of these changes is demonstrated in the pay scenario charts.

WPP’s compensation philosophy

Our mission statement and our six business objectives shape our compensation philosophy. Broadly, our Directors’ Compensation Policy is determined by three long-standing guiding principles:

- performance-driven reward;

- competitiveness; and

- alignment with share owner interests.

Specifically, our six business objectives are reflected in the design of our compensation plans as set out below:

|

WPP’s six business objectives |

Alignment with compensation structure |

|

1

|

Continue to improve operating margins on net sales |

Short-term incentive measure for the Group chief executive and Group chief financial officer |

|

2

|

Increase flexibility in the cost structure |

Short-term incentive measure for the Group chief financial officer |

|

3

|

Use free cash flow to enhance share owner value and improve return on capital employed |

TSR, EPS growth and average ROE are long-term incentive measures for the Executive Directors |

|

4

|

Continue to develop the value added by the parent company |

Short-term incentive measures (parent company-led efficiency projects) for the Group chief executive and Group chief financial officer |

|

5

|

Emphasise revenue and net sales growth more as margins improve |

Short-term incentive measures for the Group chief executive and Group chief financial officer |

|

6

|

Improve still further the creative capabilities and reputation of all our businesses |

Short-term incentive measure for the Group chief executive |

Our Directors’ Compensation Policy is designed to attract and retain best-in-class talent. The policy looks to incentivise directors to develop the skills of the Group’s employees in order to consistently exceed our clients’ expectations, driving and rewarding sustainable and exceptional performance, thereby producing long-term value for share owners. In applying this policy, the committee takes into account the pay and conditions elsewhere in the Group, which in turn are informed by general market conditions and internal factors such as the performance of the Group or relevant business unit.

Considerations taken into account when setting our Directors’ Compensation Policy

Employment conditions at WPP

When reviewing changes to the compensation levels for the directors, the committee considers any changes in light of increases awarded across the Group over a relevant period of time, in conjunction with the other factors set out in the policy table. Due to the global nature of the business and the distribution of our 132,657 employees over 112 countries, it was not practical to consult them when drawing up our new policy.

Share owner views

During 2016, the main focus from WPP share owners, as well as the media more generally, was on executive compensation. WPP has worked diligently to listen to all views and create a policy that is both acceptable for share owners as well as attractive and retentive for Executive Directors.

WPP continues to engage openly with share owners and institutional investors to discuss matters relating to compensation. The feedback received during these conversations is valuable and is among the factors that inform the decisions made by the committee.

Glossary

The following are acronyms used throughout the policy:

| Acronym |

Definition |

| DEPs |

Dividend Equivalent Payments |

| DSUs |

Deferred Stock Units |

| EPSP |

Executive Performance Share Plan – long-term incentive plan introduced in 2013 |

| ESA |

Executive Share Award – the part of the STIP that is deferred into shares |

| Good Leaver |

Broadly, when an individual is dismissed other than for cause (the particular meaning applicable to each share plan can be found in the relevant rules) |

| RSP |

Restricted Stock Plan |

| STIP |

Short-term Incentive Plan – the annual incentive plan comprising a cash bonus and an ESA

|

Directors’ Compensation Policy table – Executive Directors

The following table sets out details of the proposed compensation elements for WPP’s Executive Directors.

| Component and purpose |

Operation |

Performance |

Maximum annual opportunity |

|

Fixed elements of compensation

|

Base salary

To maintain package competitiveness and reflect skills and experience.

|

Base salary levels are reviewed every two years or following a significant change in the scope of a role. The base salary number includes a director fee of £100,000.

Levels are determined by taking a number of relevant factors into account including individual and business performance, level of experience, scope of responsibility, compensation practices across the Group and the competitiveness of total compensation against both our competitors and companies of a similar size and complexity.

|

Company and personal performance will be taken into account during the review process.

|

Under normal circumstances base salary will increase by no more than the local rate of inflation over the period since last review.

In the event of a promotion or a significant change in the scope of the role, or changes in sector competitive pay or the need to counter a competitive external offer, the committee may exceed this limit.

|

|

Short-term incentives (details of how performance measures and targets are set are included in the notes to this table below)

|

Cash bonus, Executive Share Awards (ESA)

To drive the achievement of business priorities for the financial year and to motivate, retain and reward executives over the short and medium term, while maximising alignment with share owner interests.

|

Overview

The committee may invite executives to participate in the STIP under which a bonus can be made subject to performance measured over the financial year. Bonus opportunity is determined as a percentage of salary.

Performance measures and targets are reviewed and set annually to ensure continuing strategic alignment. Achievement levels are determined following year-end by the committee, based on performance against targets.

Executive Directors’ bonuses are delivered in the form of a cash award and a deferred share award (ESA), the latter constituting at least 40% of the total bonus achieved. The ESA will vest after a minimum of two years subject to continued employment, together with additional shares in respect of accrued dividends.

Judgement

The committee will use its judgement to set the performance measures and targets annually.

Malus provisions (ESA)

The committee has the ability to reduce any unvested ESA in certain situations, including when fraud or a material misstatement has affected the level of any performance-related compensation.

Clawback provisions

The committee has the ability to clawback cash bonus, earned in respect of the performance year 2016 or after, in the three years post payment in certain situations, including when fraud, breach of fiduciary duty or a material misstatement has affected the level of any performance-related compensation.

|

70% subject to financial performance, either at a Group and/or divisional level depending on the role.

30% subject to individual objectives linked to the strategy of WPP or the relevant business area.

The committee will use its judgement in assessing performance relative to targets and expectations communicated at the start of the year and will consider unforeseen factors that may have impacted performance during the period.

Vesting schedule

The following table sets out the level of bonus payable for threshold and target performance as a percentage of maximum. Vesting operates on a straight-line basis between these points.

|

Threshold

|

Target (as percentage of maximum)

|

|

Sir Martin Sorrell

|

0%

|

50%

|

|

Other Executive Directors

|

0%

|

66%

|

|

Group chief executive: 400% of base salary.

Other Executive Directors: 250% of base salary.

The value of any accrued dividends will vary depending on the size of the ESA awarded, dividends declared and share price over the deferral period.

|

|

Long-term incentives (details of how performance measures and targets are set are included in the notes to this table on pages below)

|

Executive Performance Share Plan (EPSP)

To incentivise long-term performance and to focus on long-term retention and strategic priorities, while maximising alignment with share owner interests.

|

Overview

Executives may receive an annual conditional award expressed as a percentage of base salary. Executives may also receive an award in respect of the number of reinvested dividends proportionate to the amount of the award vesting, the dividends declared during the performance period and the share price at the time the dividend is declared. Awards will vest subject to performance, measured over a period of five consecutive financial years.

In respect of merger and acquisition activity within the peer group, the committee has an established and operated policy that TSR outcomes should not be impacted by the speculation or actuality of takeovers of peer group companies (including WPP). This policy includes a minimum listing requirement, an approach for the reinvestment of proceeds from shares of companies that delist during the performance period and parameters for companies subject to bid speculation. Details of how this policy is implemented will be disclosed each year in the relevant Annual Report.

In accordance with the EPSP rules that were approved by share owners at the 2013 AGM, if the committee considers that there has been an exceptional event or that there have been exceptional circumstances during a performance period that have made it materially easier or harder for the Company to achieve a performance measure, the committee may adjust the extent to which an award vests to mitigate the effect of the exceptional event or circumstances.

Judgement

The committee will use its judgement to set the performance measures and targets annually.

Malus provisions

The committee has the ability to reduce any unvested EPSP award in certain situations, including when fraud or a material misstatement has affected the level of any performance-related compensation.

Clawback provisions

The committee has the ability to clawback the amount net of tax received by an executive from the proceeds of the vesting of an award granted in 2016 or later years, in the three years post-payment, in certain situations, including when fraud, breach of fiduciary duty or a material misstatement has affected the level of any performance-related compensation.

|

One-third relative TSR.

One-third headline EPS growth.

One-third average ROE.

All measures are assessed independently of each other.

TSR is measured on a market- capitalisation weighted basis against a peer group of business competitors that are selected according to size and relevance. This peer group is reviewed annually at the start of each cycle to ensure it remains robust, appropriate and relevant in light of WPP’s business mix. Half of the TSR element is measured on a local currency basis, half on a common currency basis.

EPS is defined as WPP’s headline diluted earnings per share. The EPS performance is calculated by taking the aggregate EPS over the performance period and calculating the compound annual growth from the financial year preceding the start of the period.

ROE is calculated as diluted EPS divided by the average balance sheet per share value of share owners’ equity during the year.

Vesting schedule

Awards will vest from 15% for threshold performance and 100% for maximum performance.

|

Conditional awards:Plan maximum: 9.75 times base salary.

Group chief executive:6 times base salary.

Other Executive Directors: 3 times base salary.

The value of accrued dividends will vary depending on the level of vesting, dividends declared and share price over the performance period.

|

|

Other items of compensation

|

Dividend Equivalent Payments (DEPs) on the DSUs

To ensure that Sir Martin Sorrell receives an amount equal to the dividends that would be payable if he had taken receipt of and retained the shares underlying the DSUs.

|

The Company has previously received share owner approval to allow Sir Martin Sorrell to defer receipt of the DSUs. The Company makes a cash payment to Sir Martin Sorrell of an amount equal to the dividends that would have been due on the shares comprising the DSUs.

This benefit will cease in November 2017.

|

No longer subject to a performance requirement as this was assessed at the point of vesting in 1999.

|

The value of any accrued dividends will vary depending on the dividends declared during the deferral period.

|

Benefits

Provide a fixed and non-itemised allowance, to enable the executive to procure benefits to enable them to undertake their role and ensure their wellbeing and security.

|

The fixed allowance will be reviewed periodically by the committee and any changes will be effective for the next fiscal year. The allowance is set with regard to the individual concerned and the role they undertake.

Should the executive be required to relocate to a different country, a relocation benefit may be provided in addition to the allowance depending on the prevailing circumstances.

|

Not applicable.

|

Fixed benefit allowances are as follows:Group chief executive: £200,000

Group chief financial officer: $85,000.

|

Pension

To enable provision for retirement benefits.

|

Pension is provided by way of contribution to a defined contribution retirement arrangement, or a cash allowance, determined as a percentage of base salary.

|

Not applicable.

|

Group chief executive: 30% of base salary.

Group chief financial officer: 30% of base salary.

New Executive Director appointee to the Board: 25% of base salary.

|

Notes to the policy table

Plan rules

Copies of the various plan rules are available for inspection at the Company’s registered office and head office. The Directors’ Compensation Policy table for Executive Directors provides a summary of the key provisions relating to their ongoing operation.

The committee has the authority to ensure that any awards being granted, vested or lapsed are treated in accordance with the plan rules which are more extensive than the summary set out in the table.

Selection of performance measures

STIP

Performance measures are selected by the committee on the basis of their alignment to Group strategy and are the key measures to oversee the operation of the business. Measures are reviewed annually by the committee taking into account business performance and priorities.

EPSP

EPS growth is a measure that is important for both management and our share owners, capturing growth in revenue and earnings. ROE is similarly important, and provides a positive counterbalance and risk management mechanism through the focus on both growth and capital efficiencies. With the inclusion of relative TSR, the plan also takes account of share owner views of how WPP has performed relative to the companies in the peer group.

Calibration of performance targets

STIP

The performance targets for the STIP are set to incentivise year-on-year growth and to reward strong, sustainable performance. Strategic targets are based upon the annual business priorities. The committee is of the view that the targets for the STIP are commercially sensitive and it would be detrimental to the Company to disclose them in advance of or during the relevant performance period. The committee will disclose those targets at the end of the relevant performance period in that year’s Annual Report, if those targets are no longer commercially sensitive.

EPSP

Operational targets under the EPSP are set taking into account a combination of factors, but primarily internal forecasts, analysts’ expectations (albeit, the period over which analysts’ forecast is generally shorter than the five-year performance period) and historical performance relative to budgets.

Relative TSR targets are set to ensure they are more stretching than UK norms and require out-performance of our peers at median before any reward is triggered.

Cascade to WPP Group pay policy

As well as setting the policy for the Executive Directors, the committee is also responsible for reviewing the policy for the most senior people at WPP outside the Board.

Compensation packages for these individuals are normally reviewed every 18-24 months. As is the case for Executive Directors, the WPP Group pay policy ensures a clear and direct link between the performance of the Group or relevant operating company and compensation. Substantial use of performance-driven compensation not only ensures the continued alignment of the interests of share owners and senior individuals within the Group, but also enables the Group to attract, retain and motivate the talented people upon whom our success depends.

WPP is committed to encouraging strong performance through a reward system that aligns management’s interests with those of share owners.

From a compensation perspective, this is encouraged in a number of ways:

- Senior executives participate in the same long-term incentive plan as the Executive Directors, which is designed to incentivise growth, capital efficiency and share price appreciation; and

- Share ownership is encouraged for the WPP Leaders (approximately the top 300 executives), all of whom have stretching ownership goals.

Across the workforce more broadly, many employees participate in bonus and commission plans based on the performance of their employing company. Where locally competitive, employees are provided with company-sponsored pension plans and life assurance plans and a range of other benefits. In addition to these compensation elements, the Company also uses share-based compensation across the workforce to incentivise, retain and recruit talent which encourages a strong ownership culture among employees. The main share plans are described below.

Restricted Stock Plan

The RSP is used to satisfy awards under the short-term incentive plans (including ESAs) as well as to grant awards to management under the WPP Leaders, Partners and High Potential program. In this program, awards are made to participants that vest three years after grant, provided the participant is still employed within the Group.

Executive Directors, and other senior management employees, receive part of their annual bonus entitlement as a deferred share award (ESA) under the RSP. Executive Directors are ineligible to participate in any other aspect of the management share award program.

Share Option Plan 2015

The WPP plc Share Option Plan 2015 is an all-employee plan that makes annual grants of stock options to employees with two years of service who work in wholly-owned subsidiaries. This plan replaced the legacy Worldwide Ownership Plan.

The WPP plc Share Option Plan 2015 has the capability to make grants of executive share options in order to attract or retain key talent. Such awards are made infrequently. There were no grants of executive share options in 2016, or 2015. The Executive Directors do not participate in this plan.

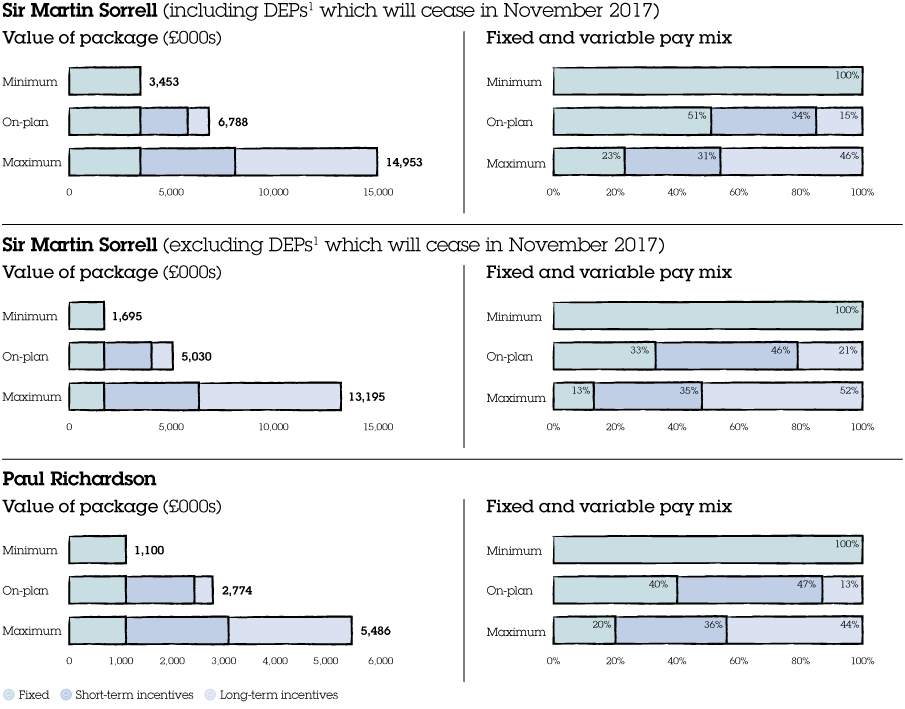

How do these pay policies affect potential compensation packages?

These graphs seek to demonstrate how pay varies with performance. The graphs are reflective of the pay policy that is being presented for approval at the 2017 AGM.

- Fixed

- Short-term incentives

- Long-term incentives

The graphs are informed by three performance scenarios and these, along with the assumptions used, are summarised below.

| Fixed elements |

Consists of base salary, benefits (including DEPs where indicated) and pension |

| Base salary reflect current levels (FY2017) |

| The DEPs are consistent with the single figure table for FY2016. Benefits reflect the fixed benefits allowances under the proposed policy |

| Pension reflects contributions under the proposed policy |

| £0002 |

Base salary |

Benefits (inc. DEPs) |

Pension |

Total fixed |

| Sir Martin Sorrell |

1,150 |

1,9581 |

30% |

3,453 |

| Paul Richardson |

798 |

63 |

30% |

1,100 |

| Short-term incentives |

On-plan scenario assumes target bonus is paid |

| Maximum scenario assumes the full bonus is paid |

| % of salary |

Below threshold |

On-plan |

Maximum |

| Sir Martin Sorrell |

0% |

200% |

400% |

| Paul Richardson |

0% |

165% |

250% |

| Long-term incentives |

On-plan scenario assumes threshold vesting of an award at the proposed policy level |

| Maximum scenario assumes full vesting of an award at the proposed policy level |

| % of salary |

Below threshold |

On-plan |

Maximum |

| Sir Martin Sorrell |

0% |

90% |

600% |

| Paul Richardson |

0% |

45% |

300% |

Other Executive Director policies

Legacy share awards and obligations

Under the Directors’ Compensation Policy, Sir Martin Sorrell’s deferred awards will be paid in accordance with the terms agreed at the time and set out in previous Compensation Committee reports. The key terms of Sir Martin’s deferred awards are summarised below.

Deferred awards (Sir Martin Sorrell only)

The Company has previously received share owner approval to allow Sir Martin Sorrell to defer receipt of his UK and US 2004, 2005 and 2007 LEAP awards and the UK part of his 2006 and 2009 LEAP awards. The UK awards are options that can be exercised at any time until November 2017. The US awards will vest on the earlier of the end of Sir Martin’s employment with the Company, a change in control of the Company and 30 November 2017. Additional shares will continue to accrue in respect of dividends paid up to the point of exercise (UK) or vesting (US).

The Company has also previously received share owner approval to allow Sir Martin Sorrell to defer receipt of the UK and the US Deferred Stock Units (DSUs). These are the awards that originally vested in 1999, having been granted in 1995 under the Capital Investment Plan. The UK DSU is an option that can be exercised at any time until November 2017. The US DSU will vest on the earlier of the end of Sir Martin’s employment with the Company, a change in control of the Company and 30 November 2017. In accordance with share owner approval, Sir Martin Sorrell receives cash dividend equivalent payments (DEPs) in respect of these deferred awards as noted in the policy table.

Share ownership guidelines

Executive Directors and other members of the senior management team are subject to share ownership guidelines which seek to reinforce the WPP principle of alignment of management’s interests with those of share owners.

The following levels of ownership are required to be achieved by the Executive Directors (unchanged for 2017):

| |

% of base salary

|

|

Group chief executive

|

600%

|

|

Group chief financial officer

|

300%

|

|

Minimum for any other new executive appointed to the Board

|

200%

|

Executive Directors will be permitted a period of seven years from the date of their appointment to achieve the guideline level.

In the event that an Executive Director fails to achieve the required levels of share ownership, the committee will decide what remedial action or penalty is appropriate. This may involve a reduction in future share awards or requiring the director to purchase shares in the market to meet the ownership guidelines.

Appointments to the Board

This section sets out details with respect to the appointment of a new Executive Director to the Board of WPP, whether it is an external or internal appointment.

Fixed compensation

Base salary will be set taking into account a range of factors, including the profile and prior experience of the candidate, internal relativities, cost and external market data. If base salary is set at a lower initial level, contingent on individual performance, the committee retains the discretion to realign the base salary over a phased period of one to three years following appointment, which may result in an exceptional rate of annualised increase in excess of that set out in the policy table.

Other elements of fixed pay will be set in accordance with the policy table. A new appointment may require the committee to rely on the authorised discretion (as set out in the Notes to the policy table section ) to make payments related to relocation, for example, in order to facilitate the appointment.

Ongoing variable compensation

The committee will seek to pay only that level of reward necessary to recruit the exceptional talent needed to lead such a complex global group. The actual level of incentive offered will be dependent on the role and existing package of the candidate. The aggregate maximum face value for annual short- and long-term variable compensation will be 8 times base salary, which is materially lower than the current Group chief executive maximum level.

The committee retains the discretion to make awards on recruitment, within the policy limits, to provide an immediate alignment of interest with the interests of share owners.

Buy-out awards

The committee may consider buying-out compensation entitlements that the individual has had to forfeit by accepting the appointment. The structure and value of the awards will be informed by the structure and value of those entitlements being forfeited, and the performance targets, time horizon and vehicle will be set in an appropriate manner at the discretion of the committee. The intention of the committee is that any award will take the form of WPP shares and will be subject to performance as far as possible.

An announcement of the director’s appointment, detailing the incumbent’s compensation will be made on a timely basis through a regulatory information service and posted on the Company’s website.

Service contracts

The following terms will apply for any new executive role appointed to the Board in the future.

- Executives will normally be appointed on a notice period of up to 12 months, although the committee retains the discretion to appoint an external candidate on a notice period of up to 24 months reducing on a rolling basis to 12 months (such that after 12 months’ service the notice period would have reverted to the standard 12 months).

- At the committee’s discretion, any payment in lieu of notice will be restricted to base salary, benefits and pension.

- On termination, entitlements will lapse when classified as a bad leaver (defined within the incentive plans). Otherwise base salary, benefits and pension allowance are payable as per the notice period and the committee will have the power to make phased payments that would be reduced or stopped if alternative employment is taken up.

Terms specific to internal appointments

The committee can honour any pre-existing commitments if an internal candidate is appointed to the Board.

Service contracts

The Company’s policy on Executive Directors’ service contracts is that they should be on a rolling basis without a specific end date.

The effective dates and notice periods under the current Executive Directors’ service contracts are summarised below:

| |

Effective from

|

Notice period

|

|

Sir Martin Sorrell

|

19 November 2008

|

‘At will’

|

|

Paul Richardson

|

19 November 2008

|

12 months

|

Sir Martin Sorrell’s service contract may be terminated by either the Company or Sir Martin without any notice, and without any payment in lieu of notice.

The Executive Directors’ service contracts are available for inspection at the Company’s registered office and head office.

Loss of office provisions

Fixed compensation elements

As noted above, the service contract of Paul Richardson provides for notice to be given on termination.

The fixed compensation elements of the contract will continue to be paid in respect of any notice period. There are no provisions relating to payment in lieu of notice. If an Executive Director is placed on garden leave, the committee retains the discretion to settle benefits in the form of cash. The Executive Directors are entitled to compensation for any accrued and unused holiday although, to the extent it is possible and in share owner interests, the committee will encourage Executive Directors to use their leave entitlements, prior to the end of their notice period.

Except in respect of any remaining notice period, no aspect of any Executive Director’s fixed compensation is payable on termination of employment. Sir Martin Sorrell’s service contract contains an indemnity, subject to certain conditions relating to previously deferred awards, from WPP in respect of any US tax which is charged under section 280G as a result of a termination linked to a change in control of WPP. Further details are set out below.

Short- and long-term compensation elements

If the Executive Director is dismissed for cause, there is not an entitlement to a STIP award, and any unvested share-based awards will lapse. Otherwise, the table below summarises the relevant provisions from the directors’ service contracts (cash bonus) and the plan rules (RSP and EPSP), which apply in other leaver scenarios. As noted in the Notes to the policy table section, the committee has the authority to ensure that any awards that vest or lapse are treated in accordance with the plan rules, which are more extensive than the summary set out in the table below.

|

Cash bonus

|

The Executive Directors are entitled to receive their bonus for any particular year provided they are employed on the last date of the performance period.

|

|

ESA

|

Provided the Executive Director is a Good Leaver, unvested awards will be reduced on a time pro-rata basis and paid on the vesting date.

|

|

EPSP

|

The award will lapse if the executive leaves during the first year of a performance period.

Provided the Executive Director is a Good Leaver, awards will vest subject to performance at the end of the performance period and time pro-rating. Awards will be paid on the normal date.

In exceptional circumstances, the compensation committee may determine that an award will vest on a different basis.

Generally, in the event of death, the performance conditions are to be assessed as at the date of death. However, the committee retains the discretion to deal with an award due to a deceased executive on any other basis that it considers appropriate.

Awards will vest immediately on a change-of-control subject to performance and time pro-rating unless it is agreed by the committee and the relevant Executive Director that the outstanding awards are exchanged for equivalent new awards.

|

Other pre-existing terms that apply to Sir Martin Sorrell

- Sir Martin Sorrell’s deferred LEAP awards and his DSUs (as set out in Other Executive Director Policies) will be paid out unconditionally on termination of employment. The performance requirements in respect of these awards have already been met, the awards have vested and are therefore no longer subject to any leaver provisions.

- In the event any payments due to Sir Martin would be treated as ‘deferred compensation’ in accordance with US legislation and subject to section 409A requirements, those payments will be delayed. If those payments are delayed, an amount in respect of interest as a result of the delay will be due from the Company to Sir Martin.

- In the event of a change of control of WPP, the Company has agreed to indemnify Sir Martin, with the prior approval of share owners, with respect to any related personal US tax liability under the provisions of section 280G. This indemnity is subject to certain limitations that exempt the Company from liability for any tax related to the share-owner approved deferrals of certain awards. Based on the most recent review by the committee of the potential impact of this clause, it is unlikely that any 280G payment would be due from the Company based on an analysis, using standard assumptions. This was reviewed by independent counsel.

Other committee discretions not set out above

- Leaver status: the committee has the discretion to determine an executive’s leaver classification in light of the guidance set out within the relevant plan rules, except with respect to Sir Martin Sorrell. Unless Sir Martin Sorrell is terminated for cause, he will be treated as having retired on leaving the Company and therefore be treated in accordance with the plan rules as a Good Leaver.

- Settlement agreements: the committee is authorised to reach settlement agreements with departing executives, informed by the default position set out above.

External appointments

Executive Directors are permitted to serve as non-executives on the boards of other organisations. If the Company is a share owner in that organisation, non-executive fees for those roles are waived. However, if the Company is not a share owner in that organisation, any non-executive fees can be retained by the office holder.

Directors’ Compensation Policy table – chairman and non-executive directors

The following table sets out details of the ongoing compensation elements for WPP’s chairman and non-executive directors. No element of pay is performance-linked.

|

Component and purpose

|

Operation

|

Maximum annual opportunity

|

Base fees

To reflect the skills and experience and time required to undertake the role.

|

Fees are reviewed at least every two years and take into account the skills, experience and time required to undertake the role, as well as fee levels in similarly-sized UK companies.

The chairman and non-executive directors receive a ‘base fee’ in connection with their appointment to the Board.

|

An overall cap on all non-executive fees, excluding consultancy fees, will apply consistent with the prevailing and share owner-approved limit in the Articles of Association.

|

Additional fees

To reflect the additional time required in any additional duties for the Company.

|

Non-executive directors are eligible to receive additional fees in respect of serving as:

• Senior independent director

• Chairman of a Board Committee

• Member of a Board Committee

• Consultancy fees in respect of other work that falls outside the remit of their role for the Company.

|

An overall cap on all non-executive fees, excluding consultancy fees, will apply consistent with the prevailing and share owner-approved limit in the Articles of Association.

Consultancy fees will be set on a discretionary basis, taking account of the nature of the role and time required.

|

Benefits and allowances

To enable the chairman and non-executive directors to undertake their roles.

|

The Company will reimburse the chairman and non-executive directors for all reasonable and properly documented expenses incurred in performing their duties of office.

The Company may provide additional allowances to facilitate the operation of the Board such as a travel allowances for attendance at international meetings.

In the event that the reimbursement of these expenses gives rise to a personal tax liability for the chairman or non-executive director, the Company retains the discretion to meet this cost (including, where appropriate, costs in relation to tax advice and filing).

While not currently offered, the Company retains the discretion to pay additional benefits to the chairman including, but not limited to, use of car, office space and secretarial support.

|

Benefits and allowances for the chairman will be set at a level that the committee feels is required for the performance of the role.

|

Other chairman and non-executive director policies

Letters of appointment for the chairman and non-executive directors

Letters of appointment have a two-month notice period and there are no payments due on loss of office.

Appointments to the Board

Letters of appointment will be consistent with the current terms as set out in this Annual Report. The chairman and non-executive directors are not eligible to receive any variable pay. Fees for any new non-executive directors will be consistent with the operating policy at their time of appointment. In respect of the appointment of a new chairman, the committee has the discretion to set fees taking into account a range of factors including the profile and prior experience of the candidate, cost and external market data.

Payments in exceptional circumstances

In truly unforeseen and exceptional circumstances, the committee retains the discretion to make emergency payments which might not otherwise be covered by this policy. The committee will not use this power to exceed the recruitment policy limit, nor will awards be made in excess of the limits set out in the Directors’ Compensation Policy table. An example of such an exceptional circumstance could be the untimely death of a director, requiring another director to take on an interim role until a permanent replacement is found.