Project AgroBanking

By Grey - Dhaka

For United Commercial Bank Brand Ucash

Highly Commended in category Advertising

In subcategory Promo & Activation

Project Description

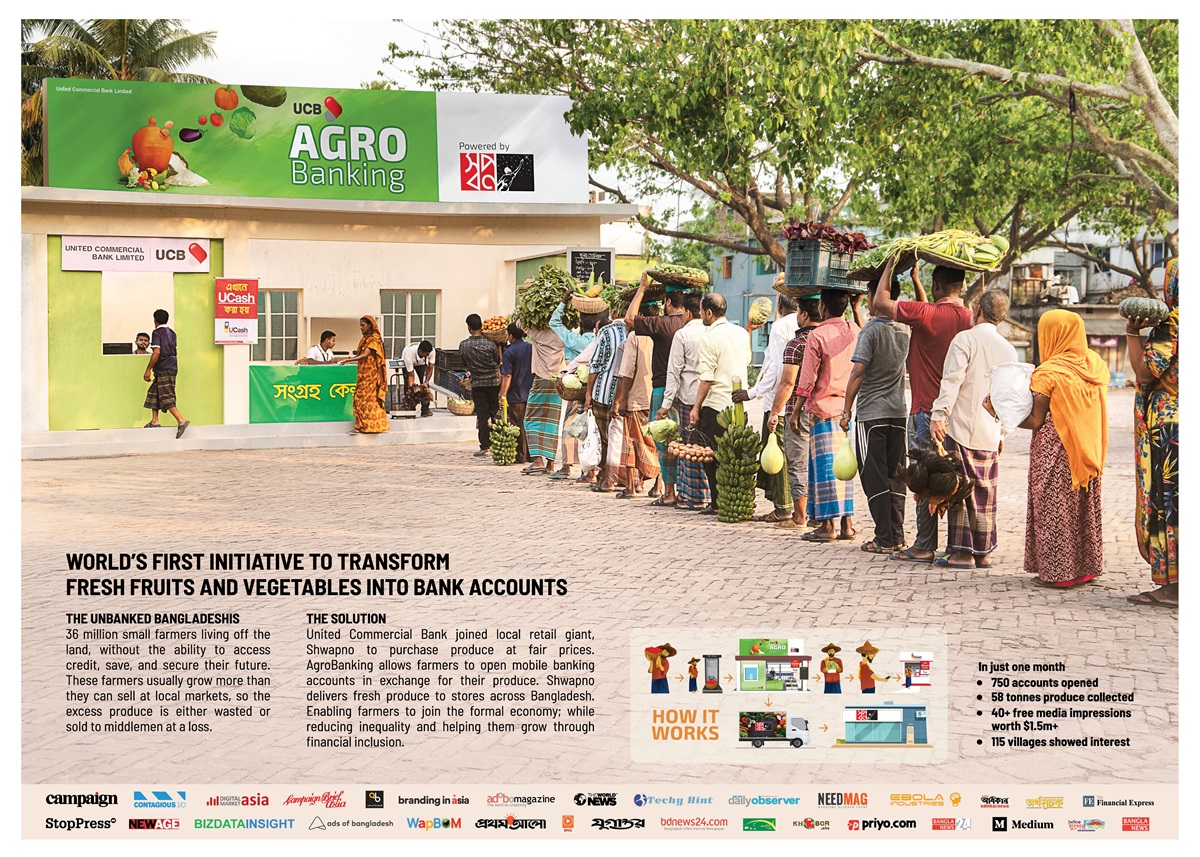

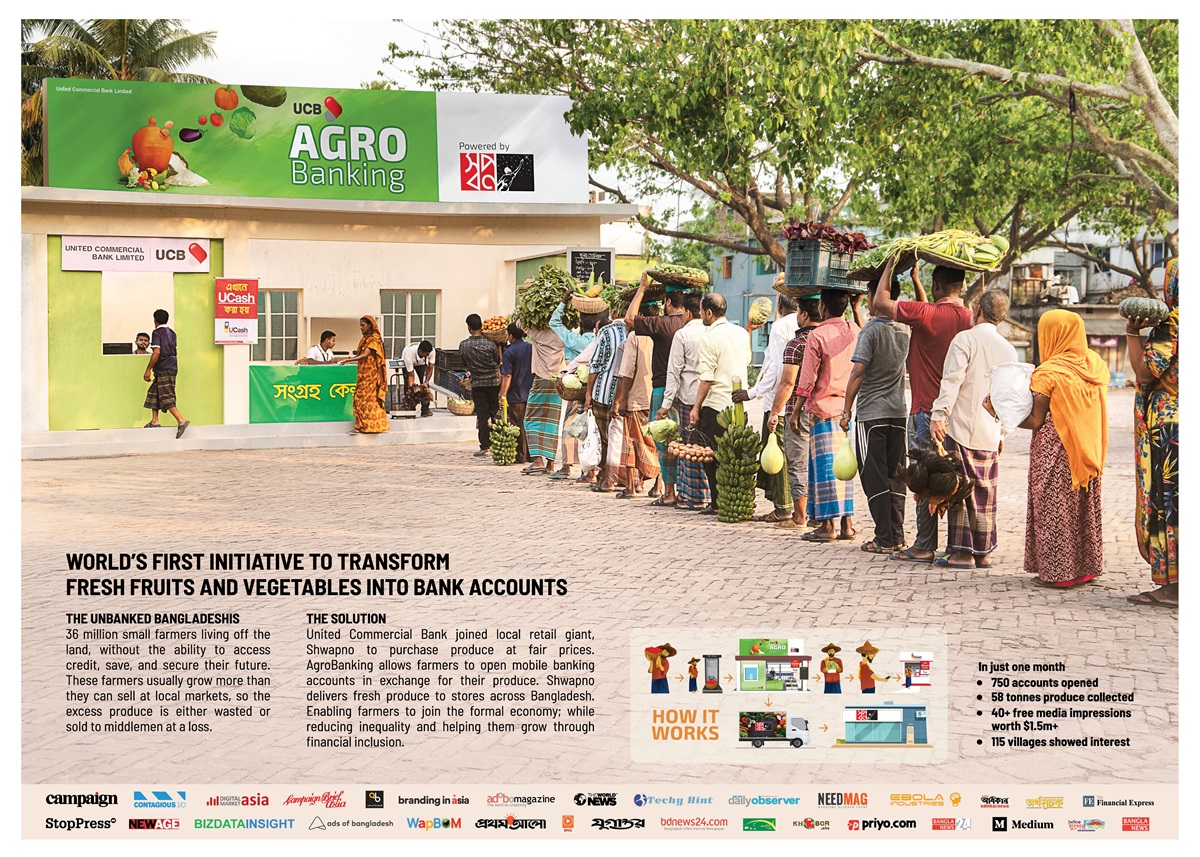

The paradox about Bangladesh is that it has become one of the fastest growing economies in the world with half of its adults remaining financially excluded. Lack of sufficient fund, high cost of financial transaction and lack of banks dedication to offer diversified services are seen to be the major roadblocks for greater financial inclusion. Hence, they remain as the futile long-tail for the banks. In Bangladesh, agriculture is the largest employment sector and most of the unbanked population are farmers by profession, living in the rural areas. So, the 36 million farmers are the financial outcasts who are living off the land, and without the ability to access credit, save, and secure their future. United Commercial Bank (UCB), one of the biggest banks in Bangladesh, decided to bring a change in their outlook about the financially excluded ones and make the banking facilities approachable and accessible for them.

One of the key objective of this idea is to bring a change in their outlook about the financially excluded ones and solve the farmer’s problem of accessing banking services and getting fair price for their excess produce.

One of the key objective of this idea is to bring a change in their outlook about the financially excluded ones and solve the farmer’s problem of accessing banking services and getting fair price for their excess produce.

Agency Solution

The unbanked farmers don’t have enough cash to go to banks, but they grow fresh produce which often yielded more than they needed. However, the amount of excess produce is more than individual families need but too little to sell in the wholesale market. Therefore, those are generally sold at unfairly low prices where the middlemen get benefited the most. So, we thought of solving both the issues i.e. lack of funds for the farmers and getting unfair prices for the excess produce, through one idea – AgroBanking. AgroBanking is the world’s first initiative to transform fresh fruits and vegetables into bank accounts. It allows farmers to open micro savings accounts in exchange for their produce. The initiative is designed to enable farmers to build credit histories, amass savings and eventually become eligible for other benefits like loans.

UCB doesn’t have full-branches in rural areas. But they have UCash (mobile financial service brand) agent points and UCB Agent Banking outlets in some villages. So, the idea was to set up co-branded points of UCB and Shwapno, at the UCash points or UCB Agent Banking points where available, and in mobile vans where none of these are available. At those points, the fresh produce was collected by UCB and the equivalent amount of money was deposited into the farmer’s account. The farmer would get an SMS-notification and can keep record in the deposit book. One could also withdraw from account at that point. The price would be fixed every morning based on the rate in the wholesale market. Everyday Shwapno’s van would take the fresh produce to the nearest Shwapno outlets. A few weeks prior to the launch, megaphone announcements and posters were pasted in the implementing areas.

UCB doesn’t have full-branches in rural areas. But they have UCash (mobile financial service brand) agent points and UCB Agent Banking outlets in some villages. So, the idea was to set up co-branded points of UCB and Shwapno, at the UCash points or UCB Agent Banking points where available, and in mobile vans where none of these are available. At those points, the fresh produce was collected by UCB and the equivalent amount of money was deposited into the farmer’s account. The farmer would get an SMS-notification and can keep record in the deposit book. One could also withdraw from account at that point. The price would be fixed every morning based on the rate in the wholesale market. Everyday Shwapno’s van would take the fresh produce to the nearest Shwapno outlets. A few weeks prior to the launch, megaphone announcements and posters were pasted in the implementing areas.