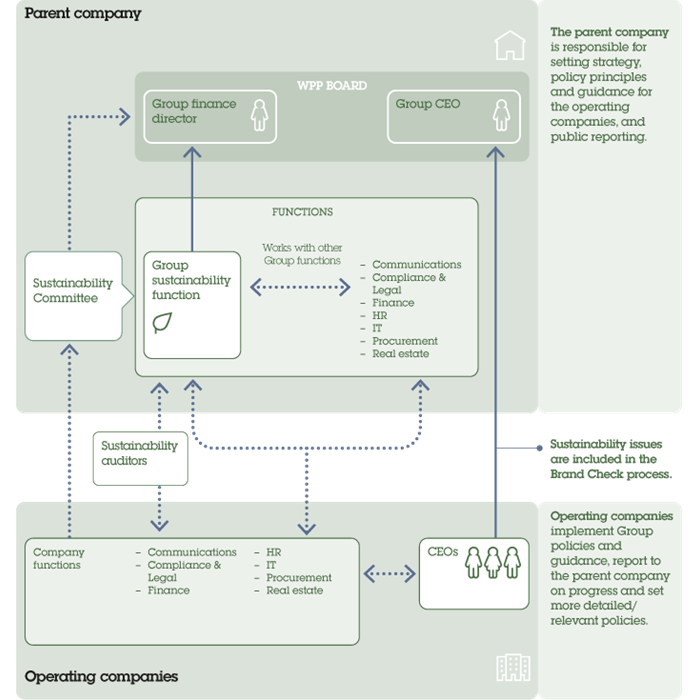

Roles and responsibilities

Paul Richardson, WPP’s Group finance director, is the Board director responsible for sustainability. He chairs

our Sustainability Committee made up of senior representatives from Group functions, which reviews progress

on key sustainability issues. Our central sustainability function develops strategy and coordinates data collection.

It communicates on sustainability matters on behalf of the Group and works with Group functions (such as

our talent team, legal, real estate, IT and procurement). The head of sustainability reports directly to the Group

finance director.

Strategic direction and policy frameworks for sustainability are established at Group level with implementation

devolved to our companies. During 2016, we appointed two sustainability advisors centrally to support our

operating companies on sustainability, build capacity and to audit compliance with the WPP Code of Business

Conduct, Sustainability Policy and Human Rights Policy Statement. During 2017, we will launch a sustainability

self-assessment questionnaire to all WPP offices to help us identify gaps in implementation focusing on governance,

employment practices, environment and supply chain. The sustainability advisors will use the results of the

assessment to identify gaps, prioritise companies for further engagement including on-site assessments and

training and promote continual improvement.

We track progress against our social and environmental performance indicators. Data is collected quarterly

through our Group financial reporting system. Our carbon and people data is verified by Bureau Veritas,

an independent assurance provider.

How we manage sustainability issues

Stakeholder engagement and materiality

We interact with a wide range of stakeholders in the course of doing business and benefit from their views and insights. Our most important stakeholder groups are clients, investors and our people.

Stakeholder feedback helps us to identify the priority sustainability issues for our business and to manage these effectively. We carried out a materiality assessment in 2014 and we updated this during 2016 through research with external stakeholders and senior people. The findings are summarised in Our materiality process.

We engaged with investors, rating agencies and benchmarking organisations on sustainability during 2016 including CDP, Dow Jones Sustainability Index, ET Carbon Index Research, La Financière de l’Echiquier, FTSE4Good, Generali Investments, Human Rights Campaign Corporate Equality Index, Institute of Business Ethics, MSCI, STOXX Global ESG Leaders, Sustainalyitics, Trillium Asset Management and Vigeo. To raise investor awareness of our activities, we submit the Sustainability section of our Annual Report for share owner voting at our AGM.

We are included in the FTSE4Good Index. We participate in the Carbon Disclosure Project (CDP) and received

a score of A- in 2016.

Corporate governance

The WPP Board of Directors is dedicated to the principles of corporate governance defined in the UK Corporate Governance Code. It also upholds our commitment to complying with the laws, regulations and guidelines that apply in the countries where we operate, such as the US Sarbanes-Oxley Act 2002, the NASDAQ rules and their related regulations. We seek to respect the guidelines issued by institutional investors and their representative bodies, wherever this is practicable.

WPP operates a system of internal control, which is maintained and reviewed in accordance with the UK Corporate Governance Code and the FRC guidance on risk management and internal control, as well as the relevant provisions of the Securities Exchange Act of 1934.

Assessing and managing our risks

The Board, with support from the Audit Committee, has overall responsibility for the system – internal

control and risk management in the Group. Social, environmental and ethical risks are considered in the Group’s risk identification, management and monitoring processes. Our approach is summarised opposite.

More detail is provided in our Annual Report including a list of principal risks and uncertainties.

Control environment and culture

The quality and competence of our people, their integrity, ethics and behaviour and the culture embedded within the Group are all vital to the maintenance of the Group’s system of internal control.

The Code of Business Conduct, which is regularly reviewed by the Board, sets out the principal obligations of all our people. Senior executives throughout the Group are required to sign this Code each year and all our people are required to complete the WPP How We Behave, Anti-Bribery and Corruption and Privacy & Data Security Awareness training modules, see Our ethical standards. The WPP Policy Book, which is updated with control bulletins, includes required practices in many operational, tax, legal and human resource areas. Breaches or alleged breaches of the Code are investigated by the director of internal audit, head of compliance, the Group chief counsel and external advisers where appropriate. Group companies are also required to follow the Data Code

of Conduct and the Code of Business Conduct – Supplier Version.

The Group has an independently operated helpline, Right to Speak, to enable our people to report issues that they

feel unable to raise locally, and anonymously, if necessary, see Our ethical standards. The Compensation Committee reviews how the Group’s performance rewards support the risk management and internal control systems.

Risk assessment

The Group uses a three lines of defence model in relation to risk management.

First, each operating company undertakes monthly and quarterly procedures and day-to-day management activities to review their operations and business risks, supported by Group policies, training and SOX and reviews within their network.

Secondly, operating network reviews are formally communicated to the Group chief executive, the Group finance director and senior parent company executives in monthly reports and quarterly review meetings. At each Board meeting, the Group chief executive presents a Brand Check review of each of the business’ operations, including an assessment of risk. This includes the possibility of winning or losing major business, succession and the addition or loss of a key executive; introduction of new legislation in an important market; sustainability, including risks relating to marketing ethics, privacy and employment; political instability and changes in accounting or corporate governance practice.

Thirdly, internal audit, with Audit Committee oversight and external resource as required, provides an independent review of risk management and internal control.

Control activities and monitoring

Policies and procedures for all operating companies are set out and communicated in the WPP Policy Book, internal control bulletins and accounting guidelines. The application of these policies and procedures is monitored within the individual businesses and by the director of internal audit, head of compliance and the Group chief counsel.

Operating companies are required to maintain and update documentation of their internal controls and processes. The internal audit department was responsible for reviews and testing of the documentation and the relevant controls for a majority of the Group during 2016, the results of which were reported to the Audit Committee.

Read more in our Annual Report, www.wpp.com/annualreports/2016/risks.

Tax policy

Tax revenues sustain national economies. We recognise our obligation to pay the amount of tax legally due in the territory in which the liability arises and comply with all legal requirements. At the same time, we have an obligation to maximise share owner value, which includes controlling our overall liability to taxation. However, we do not condone either personal or corporate tax evasion under any circumstances.

The WPP Audit Committee, which is made up of independent non-executive directors, is responsible for overseeing our policies on tax and regularly reviews our tax strategy.

The Group paid corporation taxes of £414.2 million in 2016, an increase on £301.2 million in 2015 following increased profits earned during the current year. Estimated employer social security-related taxes paid during 2016 were £660 million (2015: £625 million), and estimated employee social security-related taxes paid during 2016 were £375 million (2015: £360 million). Other taxes (primarily property taxes) paid during 2016 were £57.3 million (2015: £49.0 million).

We are starting to quantify the wider economic impacts of our business and the benefits associated with our activities including tax payments to governments. More information is available in Quantifying our impacts.

We maintain constructive engagement with the tax authorities and relevant government representatives, as well as active engagement with a wide range of international companies and business organisations with similar issues. We engage advisors and legal counsel to obtain opinions on tax legislation and principles. Where disputes arise with tax authorities, in areas of doubt or where legal interpretations differ, we aim to tackle the matter promptly and resolve it in a responsible manner.

We have a Tax Risk Management Strategy in place which sets out the controls established and our assessment procedures for decision-making and how we monitor tax risk. We monitor proposed changes in taxation legislation and ensure these are taken into account when we consider our future business plans. Our directors are informed by management of any tax law changes, the nature and status of any significant ongoing tax audits, and other developments that could materially affect the Group’s tax position.

Factors that may affect the Group’s future tax charge include the levels and mix of profits in the many countries in which we operate, the prevailing tax rates in each of those countries and also the foreign exchange rates that apply to those profits. The tax charge may also be affected by the impact of acquisitions, disposals and other corporate restructurings, the resolution of open tax issues, future planning, and the ability to use brought forward tax losses. Furthermore, changes in local or international tax rules, for example prompted by the OECD’s Base Erosion and Profit Shifting (a global initiative to improve the fairness and integrity of tax systems), or new challenges by tax or competition authorities, may expose us to significant additional tax liabilities or impact the carrying value of our deferred tax assets, which would affect the future tax charge.

The Group has a number of open tax returns and is subject to various ongoing tax audits in respect of which it has recognised potential liabilities, none of which are individually material. The Group does not currently expect any material additional charges, or credits, to arise in respect of these matters, beyond the amounts already provided.

Annual Board and Committee Evaluation

For 2016/17, the Senior Independent Director conducted the annual Board effectiveness review. The review

covered Board organization and structure, Board meetings, Board performance and responsibilities, the

Chairman’s performance and the performance of the three Board Committees. The review additionally covered

the areas previously identified by the external evaluator, including Board membership and director succession

planning (both executive and non-executive) and particular Board processes. The results of the evaluation and

feedback from interviews with Directors were discussed by the Board at its meeting in April 2017.

The review identified significant progress in WPP’s Board processes, to include in-depth engagement and

discussions with management about business operations and short- and mid-term strategy and challenges,

positive and informed interaction and collaboration among Directors, effective leadership by the Chairman,

and overall effective Committee functioning and briefings to the full Board. The review also identified progress

in certain aspects of director succession planning, which remains a focus as described below.

The recommendations to improve Board effectiveness further over the next year focused on:

- Succession planning – further developing Board activities and process for both emergency and longer term

succession plans for key senior roles at the Board level, including ongoing identification of leadership criteria

and skill sets for such roles, and increasing Board knowledge of the talent pool, both internal and external,

building on progress this past year.

- Training – development of both an induction programme for Board joiners and ongoing training and

knowledge briefings for the Non-Executive Directors.

- Board composition – further improving the contribution that the Board can make to the business, by assessing

skill sets that will match WPP’s business strategy, best practice corporate governance requirements and stake

holder expectations, so as to continue to attract the appropriate and diverse Non-Executive Director talent

for future Board refreshment, while optimising Board and Committee size.

- Use of Board time – good progress has been made, and the goal is to further develop the agenda to ensure

that a proper balance of strategy, performance and governance issues are included through the annual

cycle of board meetings, with increased time allocation for strategy, risk reviews, and the rapidly changing

industry landscape.

The Chairman, supported by the Company Secretary, will monitor and ensure progress on the implementation

of the appropriate recommendations.