The Compensation Committee would like to present the Executive Remuneration Policy. This is the policy that was

approved by share owners at the 2014 AGM. It is the intention of the committee that this policy will be maintained

for three years from approval. In 2015, the Policy was amended to remove references that were specific to Mark Read who

retired from the Board on 27 January, include references to clawback provisions being included in the incentive plans; and

inclusion of share ownership guidelines for non-executive directors. The policy is subject to periodic reviews during

its operation. The committee believes that this policy continues to align with the Company’s mission statement and

business objectives and no changes are being put to share owners for consideration at this year’s AGM.

WPP’s compensation philosophy

Our mission statement and our six business objectives shape our compensation philosophy. Broadly, our Executive

Remuneration Policy is determined by three guiding principles:

- performance-driven reward;

- competitiveness; and

- alignment with share owner interests.

Specifically, our six business objectives (as set out in How we're doing) are reflected in the design of our compensation plans as set out below:

awards outstanding under the Executive Performance Share Plan.

| |

WPP’s six business objectives |

Alignment with compensation structure |

|

1

|

Continue to improve operating margins on net sales |

Short-term incentive measure for the Group chief executive

and Group finance director |

|

2

|

Increase flexibility in the cost structure |

Short-term incentive measure for the Group finance director |

|

3

|

Use free cash flow to enhance share owner value

and improve return on capital employed |

TSR, EPS growth and average ROE are long-term incentive

measures for the executive directors |

|

4

|

Continue to develop the value added by the parent company |

Short-term incentive measures (parent company-led efficiency projects) for the Group finance director |

|

5

|

Emphasise revenue and net sales growth more as margins improve |

Short-term incentive measures for the Group chief executive and Group finance director |

|

6

|

Improve still further the creative capabilities and reputation of all our businesses |

Short-term incentive measure for the Group chief executive |

The Executive Remuneration Policy is designed to attract and retain the best-in-class talent. The policy looks to incentivise the

directors to develop the skills of the Group’s employees in order to consistently exceed our clients’ expectations. The policy’s

objective is to drive and reward sustainable and exceptional performance, thereby producing long-term value for share owners.

In applying this policy, the committee takes into account the pay and conditions elsewhere in the Group, which in turn are

informed by general market conditions and internal factors such as the performance of the Group or relevant business unit.

Considerations taken into account when setting our Executive Remuneration Policy

Employment conditions at WPP

When reviewing changes to the compensation levels for the directors, the committee considers any changes in light

of the increases awarded across the Group over a relevant period of time, in conjunction with the other factors set out

in the policy table. The committee did not consult employees when drawing up this Executive Remuneration Policy.

Share owner views

WPP continues to engage openly with share owners and institutional investors to discuss matters relating to compensation.

The feedback received during these conversations is valuable and is among the factors that inform the decisions made by

the committee.

During 2013, the committee consulted with share owners on the design of the EPSP. The selection of performance

measures took account of the feedback received. More generally, formal and informal share owner feedback was used

by the committee when drafting this Executive Remuneration Policy.

Glossary

The following are acronyms used throughout the policy:

Acronyms used throughout the policy

| Acronym |

Definition |

| DEPs |

Dividend Equivalent Payments |

| DSUs |

Deferred Stock Units |

| EPSP |

Executive Performance Share Plan – long-term incentive plan introduced in 2013 |

| ESA |

Executive Share Award – the part of the STIP that is deferred into shares |

| ExSOP |

Executive Stock Option Plan |

| Good Leaver |

Broadly, when an individual is dismissed other than for cause (the particular meaning applicable to each share plan can be found in the relevant rules) |

| LEAP |

Leadership Equity Acquisition Plan – long-term incentive plan used to grant awards until the end of 2012 |

| RSP |

Restricted Stock Plan |

| STIP |

Short-term Incentive Plan – the annual incentive plan comprising a cash bonus and an ESA |

Executive Remuneration Policy table – executive directors

The following table sets out details of the ongoing compensation elements for WPP's executive directors.

Details of the ongoing compensation elements for WPP's executive directors

| Component and purpose |

Operation |

Performance |

Maximum annual opportunity |

| Fixed elements of compensation |

|

Base salary and fees

To maintain package

competitiveness and

reflect skills and

experience.

|

Base salary and fee levels are reviewed

every two years or following a significant

change in the scope of a role.

Levels are determined by taking a

number of relevant factors into account

including individual and business

performance, level of experience, scope

of responsibility, compensation practices

across the Group and the competitiveness

of total compensation against both our

competitors and companies of a similar

size and complexity. |

Company and personal

performance will be taken

into account during the

review process. |

Under normal

circumstances base salary

and fees will increase by

no more than the local

rate of inflation over the

period since last review.

In the event of a promotion

or a significant change

in the scope of the role,

or changes in sector

competitive pay or the

need to counter a

competitive external

offer, the committee

may exceed this limit. |

| Short-term incentives (details of how performance measures and targets are set are included in the Notes to the policy table) |

|

Cash bonus, Executive Share Awards (ESA)

To drive the achievement of business priorities for the financial year and to motivate, retain and reward executives over

the medium term, while maximising alignment with share owner interests.

|

Overview

The committee may invite executives

to participate in the STIP under which

a bonus can be made subject to performance measured over the financial year. Bonus opportunity is determined

as a percentage of salary and fees.

Performance measures and targets are reviewed and set annually to ensure continuing strategic alignment. Achievement levels are determined following year-end by the committee,

based on performance against targets.

Executive directors’ bonuses are delivered

in the form of a cash award and a deferred share award (ESA), the latter constituting

at least 50% of the total bonus achieved.

The ESA will vest after a minimum of two years subject to continued employment, together with additional shares in respect

of accrued dividends.

Judgement

The committee will use its judgement

to set the performance measures and

targets annually.

Malus provisions (ESA)

The committee has the ability to reduce any unvested ESA in certain situations, including when fraud or a material misstatement has affected the level of any performance-related remuneration.

Clawback provisions

The committee has the ability to clawback cash bonus, earned in respect of the performance year 2016 or after, in the

three years post payment in certain situations, including when fraud, breach

of fiduciary duty or a material misstatement has affected the level of any performance-related remuneration.

|

70% subject to financial performance, either at a Group and/or divisional level depending on the role.

30% subject to personal objectives linked to the strategy of WPP or the relevant business area.

The committee will use its judgement in assessing performance relative to targets and expectations communicated at the start of the year and will consider unforeseen factors that may have impacted performance during the period.

Vesting schedule

The following table sets out the level of bonus payable for threshold and target performance as a percentage of maximum. Vesting operates on a straight-line basis between these points

Vesting schedule

| |

Threshold |

Target

(as percentage of maximum) |

| Sir Martin Sorrell |

0% |

50% |

| Other executive directors |

0% |

67% |

|

Group chief executive: 435% of base salary

and fees.

Other executive directors: 300% of base salary

and fees.

The value of any accrued dividends will vary depending on the size

of the ESA awarded, dividends declared

and share price over

the deferral period. |

| Long-term incentives (details of how performance measures and targets are set are included in the Notes to the policy table) |

|

Executive Performance Share Plan (EPSP)

To incentivise long-term performance and to focus on long-term retention and strategic priorities, while maximising alignment with share owner interests.

|

Overview

Executives may receive an annual conditional award expressed as a percentage of base salary and fees. Executives may also receive an award in respect of the number of reinvested dividends proportionate to the amount of the award vesting, the dividends declared during the performance period

and the share price at the time the dividend

is declared. Awards will vest subject to performance, measured over a period

of five consecutive financial years.

In respect of merger and acquisition activity within the peer group, the committee has

an established and operated policy that TSR outcomes should not be impacted by the speculation or actuality of takeovers of peer group companies (including WPP). This policy includes a minimum listing requirement, an approach for the reinvestment of proceeds from shares of companies that delist during the performance period and parameters

for companies subject to bid speculation. Details of how this policy is implemented

will be disclosed each year in the relevant Annual Report.

Discretions

In accordance with the EPSP rules that were approved by share owners at the 2013 AGM,

if the committee considers that there has

been an exceptional event or that there

have been exceptional circumstances during a performance period that have made it materially easier or harder for the Company

to achieve a performance measure, the committee may adjust the extent to which

an award vests to mitigate the effect of the exceptional event or circumstances.

Malus provisions

The committee has the ability to reduce

any unvested EPSP award in certain situations, including when fraud or a material misstatement has affected the level of any performance-related remuneration.

Clawback provisions

The committee has the ability to clawback the amount net of tax received by an executive from the proceeds of the vesting of an award granted in 2016 or later years, in the three years post payment, in certain situations, including when fraud, breach of fiduciary duty or a material misstatement has affected the level

of any performance-related remuneration.

|

One-third relative TSR.

One-third headline EPS growth.

One-third average ROE.

All measures are assessed independently of each other.

TSR is measured on a market- capitalisation weighted basis against a peer group of business competitors that are selected according to size and relevance. This peer group is reviewed annually at the start of each

cycle to ensure it remains robust, appropriate and relevant in light of WPP’s business mix. Half of the TSR element is measured on a local currency basis, half on a common currency basis.

EPS is defined as WPP’s headline, fully diluted, earnings per share. The EPS performance is calculated by taking the aggregate EPS over the performance period and calculating the compound annual growth from the financial year preceding the start of the period.

ROE is calculated as fully diluted EPS divided by the average balance sheet per share value

of share owners’ equity during

the year.

Vesting schedule

Awards will vest on a straight-line basis from 20% for threshold performance and 100% for maximum performance.

|

Conditional awards:

Plan maximum: 9.75 times base salary and fees.

Group chief executive:

9.75 times base salary

and fees.

Other directors: four times base salary and fees.

The value of accrued dividends will vary depending on the level of vesting, dividends declared and share price over the performance period.

|

| Long-term incentives (legacy plans with unvested awards) |

|

Leadership Equity Acquisition Plan III (LEAP III)

To incentivise long-term performance and to focus on long-term retention and strategic priorities, while maximising alignment with share owner interests.

|

Overview

Executives were invited to participate in

the plan annually by the committee. In order to participate, individuals must have committed to hold an investment level

in WPP shares which is determined by

the committee, subject to an overall maximum, and must be held for the full five-year performance period. Investment levels were determined by the committee, subject to an overall maximum. A final number of matching shares will be awarded, proportionate to the investment, dependent on the performance of WPP. Executives may also receive an award

in respect of the number of reinvested dividends proportionate to the amount

of the award vesting, the dividends

declared during the performance period and the share price at the time the

dividend is declared. The Plan was

closed to the grant of new awards at

31 December 2012.

Discretions

Following the end of the performance period, the committee undertakes a

‘fairness review’ to determine whether any exceptional events have impacted the outcome and that the resulting match is in line with financial performance relative to the comparator group and the underlying financial performance of the Group. Merger and acquisition activity will be treated in accordance with the policy set out under

the EPSP above.

Malus provisions

The committee has the ability to reduce any unvested LEAP III award in certain situations, including when fraud or a material misstatement has affected

the level of any performance-related remuneration.

|

100% relative TSR measured on a market-capitalisation weighted, common currency basis

Vesting schedule

The following table sets out the level of award that will vest for threshold and target performance as a percentage of maximum.

Vesting schedule

| |

Threshold |

Maximum |

| All executive directors |

30% |

100% |

To achieve threshold vesting WPP

must outperform at least 50% of the market-cap weighted peer group; to achieve maximum vesting WPP must outperform

at least 90% of the market-cap weighted peer group.

|

The following maximum levels applied at the time of grant. No further awards can be granted under LEAP III, and none have been made since 2012.

Investment: one times an executive director's total target earnings (base salary and fees plus target bonus).

Award: Five times an executive director's investment.

The value of accrued dividends will vary depending on the level of vesting, dividends declared and share price over the investment and performance period. |

| Other items in the nature of compensation |

|

Dividend Equivalent Payments (DEPs) on the DSUs

To ensure that Sir Martin Sorrell receives an amount equal to the dividends that would be payable if he had taken receipt of and retained the shares underlying the DSUs.

|

The Company has previously received share owner approval to allow Sir Martin Sorrell to defer receipt of the DSUs. The Company makes a cash payment to Sir Martin Sorrell of an amount equal to the dividends that would have been due on the shares comprising the DSUs. |

No longer subject to a performance requirement as this was assessed at the point of vesting in 1999. |

The value of any accrued dividends will vary depending on the dividends declared during the deferral period. |

|

Benefits

To enable the executives to undertake their role by ensuring their well-being and security.

|

The following benefits are payable in relation to travel and the dual headquarter split between the UK and the US to some/all of the executive directors. The provision of these benefits reflects external competitive practice, the complex nature of the Group and the significant amount of time spent travelling by the executives.

The typical benefits that executive directors receive may include a car and/or car allowance plus the use of a driver as required; medical, life and disability insurance; accommodation allowance in lieu of hotel expenses; tax and legal advice; home office support; club memberships deemed necessary for the role; and spousal travel.

Other benefits, such as those linked to the relocation of an executive, may be provided depending on the prevailing circumstances. |

Not applicable. |

Set at a level that the committee feels is required in order for the executive to carry out their role. The maximum payable will not significantly exceed the payments made in 2013, although the committee may pay more than this if the cost of providing the same benefits increases, or if the executive relocates. |

|

Pension

To enable provision for personal and dependant retirement benefits.

|

Pension is provided by way of contribution to a defined contribution arrangement, or a cash allowance, determined as a percentage of base salary and fees. |

Not applicable. |

Group chief executive: 40% of base salary and fees.

Other executive directors: 30% of base salary and fees. |

Notes to the policy table

Plan rules

Copies of the various plan rules are available for inspection at the Company’s registered office and head office. The Executive Remuneration Policy table provides a summary of the key provisions relating to their ongoing operation.

The committee has the authority to ensure that any awards being granted, vested or lapsed are treated in accordance with the plan rules which are more extensive than the summary set out in the table.

Selection of performance measures

STIP

Performance measures are selected by the committee on the basis of their alignment to Group strategy and are the key measures to oversee the operation of the business. Measures are reviewed annually by the committee taking into account business performance and priorities.

EPSP

EPS growth is a measure that is important for both management and our share owners, capturing growth in revenue and earnings. ROE is similarly important, and provides a positive counterbalance and risk management mechanism through the focus on both growth and capital efficiencies. With the inclusion of relative TSR, the plan also takes account of share owner views of how WPP has performed relative to the companies in the peer group.

Calibration of performance targets

STIP

The performance targets for the STIP are set to incentivise year-on-year growth and to reward strong, sustainable performance. Strategic targets are based upon the annual business priorities. The committee is of the view that the targets for the STIP are commercially sensitive and it would be detrimental to the Company to disclose them in advance of or during the relevant performance period. The committee will disclose those targets at the end of the relevant performance period in that year’s Annual Report, if those targets are no longer commercially sensitive.

EPSP

Operational targets under the EPSP are set taking into account a combination of factors, but primarily internal forecasts, analysts’ expectations (albeit, the period over which analysts’ forecast is generally shorter than the five-year performance period) and historical performance relative to budgets.

Relative TSR targets are set to ensure they are more stretching than UK norms and require out-performance of our peers at median before any reward is triggered.

Cascade to WPP Group pay policy

As well as setting the policy for the executive directors, the Compensation Committee is also responsible for reviewing the policy for the most senior people at WPP outside the Board.

Compensation packages for these individuals are normally reviewed every 18 – 24 months. As with the Executive Remuneration Policy, the WPP Group pay policy ensures a clear and direct link between the performance of the Group or relevant operating company and compensation. Substantial use of performance-driven compensation not only ensures the continued alignment of the interests of share owners and senior individuals within the Group, but also enables the Group to attract, retain and motivate the talented people upon whom our success depends.

WPP is committed to encouraging strong performance through a reward system that aligns management’s interests with those of share owners.

From a compensation perspective, this is encouraged in a number of ways:

- senior executives participate in the same long-term incentive plan as the executive directors, which is designed to incentivise growth, capital efficiency and share price appreciation; and

- share ownership is encouraged for the WPP Leaders (approximately the top 300 executives), all of whom have stretching ownership goals.

Across the workforce more broadly, many employees participate in bonus and commission plans based on the performance of their employing company. In addition, where locally competitive, employees are provided with company-sponsored pension plans and life assurance plans and a range of other benefits. In addition to these compensation elements, the Company also uses share-based compensation across the workforce to incentivise, retain and recruit talent which encourages a strong ownership culture among employees. The main share plans are described below.

Restricted Stock Plan

The RSP is used to satisfy awards under the short-term incentive plans (including ESAs) as well as to grant awards to management under the WPP Leaders, Partners and High Potential program. In the program, awards are made to participants that vest three years after grant, provided the participant is still employed within the Group.

Executive directors are eligible to receive ESAs under the RSP, but ineligible to participate in any other aspect of the management share award program.

Executive Stock Option Plan

The ExSOP is used to make special grants of options in order to attract or retain key talent. Awards are made infrequently and executive directors are ineligible to participate, other than in a recruitment situation (see Appointments to the Board). This plan will expire in 2015 and will be replaced by the WPP Share Option Plan 2015.

Share Option Plan 2015

The WPP Share Option Plan 2015 is an all-employee plan

that makes annual grants of stock options to employees

with two years of service who work in wholly-owned

subsidiaries. This plan replaced the legacy Worldwide

Ownership Plan.

The WPP Share Option Plan 2015 also has

the capability to make grants of executive options in

order to attract or retain key talent. Such awards are

made infrequently.

How do these pay policies affect potential compensation packages?

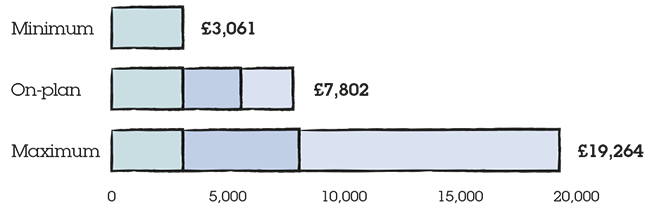

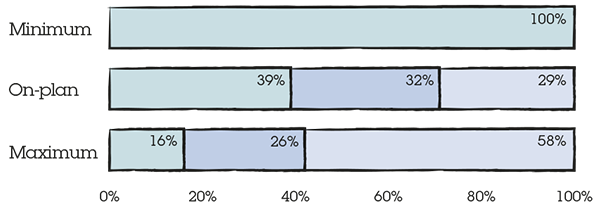

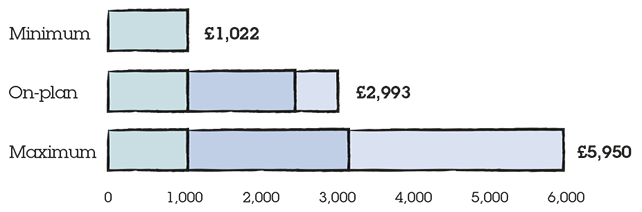

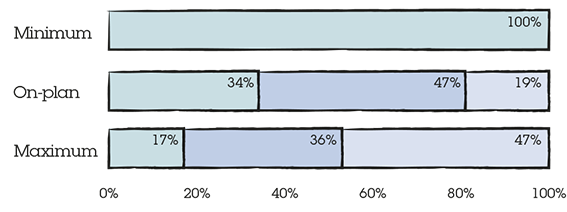

These graphs seek to demonstrate how pay varies with performance. The graphs are reflective of the pay policy at approval by share owners at the 2013 AGM. There have been no changes to figures since the approval of the policy by share owners, except benefits and DEPs. For consistency we have used the benefits and DEP figure from the year of approval by share owners (2013).

Sir Martin Sorrell £000

Fixed and variable pay mix

- Fixed

- Short-term incentives

- Long-term incentives

Paul Richardson £000

Fixed and variable pay mix

- Fixed

- Short-term incentives

- Long-term incentives

The graphs are informed by three performance scenarios and these, along with the assumptions used, are summarised below.

how pay varies with performance

| Fixed elements |

Consists of base salary and fees, benefits (including DEPs) and pension |

| Base salary and fees reflect current levels (which are unchanged from FY2013) |

| Benefits and DEPs are consistent with the single figure table for FY2013 |

| Pension reflects current levels (which are unchanged from FY2013) |

| £000 |

Base salary & fees |

Benefits (inc. DEPs) |

Pension |

Total fixed |

| Sir Martin Sorrell |

1,150 |

1,451 |

40% |

3,061 |

| Paul Richardson |

704 |

107 |

30% |

1,022 |

| Short-term incentives |

On-plan cenario assumes target bonus is paid |

| Maximum scenario assumes the full bonus is paid |

| % of salary and fees |

Below threshold |

On-plan |

Maximum |

| Sir Martin Sorrell |

0% |

217.5% |

435% |

| Paul Richardson |

0% |

200% |

300% |

| Long-term incentives |

On-plan scenario assumes threshold vesting of an award at the current policy level |

| Maximum scenario assumes full vesting of an award at the current policy level |

| % of salary and fees |

Below threshold |

On-plan |

Maximum |

| Sir Martin Sorrell |

0% |

195% |

974% |

| Paul Richardson |

0% |

80% |

400% |

Other executive director policies

Legacy share awards and obligations

Under the Executive Remuneration Policy, outstanding awards under LEAP III, the long-term incentive plan that pre-dated the EPSP, and Sir Martin Sorrell’s deferred awards will be paid in accordance with the terms agreed at the time and set out in previous Compensation Committee reports. The key terms of Sir Martin’s deferred awards are summarised below.

Deferred awards (Sir Martin Sorrell only)

The Company has previously received share owner approval to allow Sir Martin Sorrell to defer receipt of his UK and US 2004, 2005 and 2007 LEAP awards and the UK part of his 2006 and 2009 LEAP awards. The UK awards are options that can be exercised at any time until November 2017. The US awards will vest on the earlier of the end of Sir Martin’s employment with the Company, a change in control of the Company and 30 November 2017. Additional shares will continue to accrue in respect of dividends paid up to the point of exercise (UK) or vesting (US).

The Company has also previously received share owner approval to allow Sir Martin Sorrell to defer receipt of the UK and the US Deferred Stock Units Awards Agreements (DSUs). These are the awards that originally vested in 1999, having been granted in 1995 under the Capital Investment Plan. The UK DSU is an option that can be exercised at any time until November 2017. The US DSU will vest on the earlier of the end of Sir Martin’s employment with the Company, a change in control of the Company and 30 November 2017. In accordance with share owner approval, Sir Martin Sorrell receives cash dividend equivalent payments (DEPs) in respect of these deferred awards as noted in the policy table.

Share ownership guidelines

With effect from 2013/4, executive directors and other members of the senior management team were subject to share ownership guidelines. The implementation of these guidelines seeks to reinforce the WPP principle of alignment of management’s interests with those of share owners.

The following levels of ownership are required to be achieved by the executive directors:

levels of ownership are required to be achieved by the executive directors

|

% of base salary & fees |

| Group chief executive |

600% |

| Group finance director |

300% |

| Minimum for any other

new executive appointed

to the Board |

200% |

Executive directors will be permitted a period of seven years from the date of their appointment to achieve the guideline level.

In the event that an executive director fails to achieve the required levels of share ownership, the committee will decide what remedial action or penalty is appropriate. This may involve a reduction in future share awards or requiring the director to purchase shares in the market to meet the ownership guidelines.

Appointments to the Board

This section sets out details with respect to the appointment of a new executive director to the Board of WPP, whether it is an external or internal appointment.

Fixed compensation

Base salary and fees will be set taking into account a range of factors, including the profile and prior experience of the candidate, internal relativities, cost and external market data. If base salary and fees are set at a lower initial level contingent on individual performance, the committee retains the discretion to realign the base salary and fees over a phased period of one to three years following appointment, which may result in an exceptional rate of annualised increase in excess of that set out in the policy table.

Other elements of fixed pay will be set in accordance with the policy table, and a new appointment may require the committee to rely on the authorised discretion to make payments related to relocation, for example, in order to facilitate the appointment.

Ongoing variable compensation

The committee will seek to pay only that level of reward necessary to recruit the exceptional talent needed to lead such a complex global group. The actual level of incentive offered will be dependent on the role and existing package of the candidate. The aggregate maximum face value for annual short- and long-term variable compensation will be 10 times base salary and fees, which is materially lower than the current Group chief executive maximum level. The committee retains the discretion to make awards on recruitment, within the policy limits, to provide an immediate alignment of interest with the interests of share owners.

Buy-out awards

The committee may consider buying-out remuneration entitlements that the individual has had to forfeit by accepting the appointment. The structure and value of the awards will be informed by the structure and value of those entitlements being forfeited, and the performance targets, time horizon and vehicle will be set in an appropriate manner at the discretion of the committee. The intention of the committee is that any award will take the form of WPP shares and will be subject to performance as far as possible.

An announcement of the director’s appointment, detailing the incumbent’s compensation will be made on a timely basis through a regulatory information service and posted on the Company’s website.

Service contracts

The following terms will apply for any new executive role appointed to the Board in the future.

- Executives will normally be appointed on a notice period of up to 12 months, although the committee retains the discretion to appoint an external candidate on a notice period of up to 24 months reducing on a rolling basis to 12 months (such that after 12 months’ service the notice period would have reverted to the standard 12 months).

- At the committee’s discretion, any payment in lieu of notice will be restricted to base salary, fees, benefits and pension.

- On termination there will be no entitlements when classified as a bad leaver (defined within the incentive plans). Otherwise base salary, fees, benefits and pension allowance are payable as per the notice period and the committee will have the power to make phased payments that would be reduced or stopped if alternative employment is taken up.

Terms specific to internal appointments

The committee can honour any pre-existing commitments if an internal candidate is appointed to the Board.

Service contracts

The Company’s policy on executive directors’ service contracts is that they should be on a rolling basis without a specific end date.

The effective dates and notice periods under the current executive directors’ service contracts are summarised below:

The effective dates and notice periods under the current executive directors' service contracts

|

Effective from |

Notice period |

| Sir Martin Sorrell |

19 November 2008 |

'At will' |

| Paul Richardson |

19 November 2008 |

12 months |

Sir Martin Sorrell’s service contract may be terminated by either the Company or Sir Martin without any notice, and without any payment in lieu of notice.

The executive directors’ service contracts are available for inspection at the Company’s registered office and head office.

Loss of office provisions

Fixed compensation elements

As noted above, the service contract of Paul Richardson provide for notice to be given on termination. The fixed compensation elements of the contract will continue to be paid in respect of any notice period. There are no provisions relating to payment in lieu of notice. If an executive director is placed on garden leave, the committee retains the discretion to settle benefits in the form of cash. The executive directors are entitled to compensation for any accrued and unused holiday although, to the extent it is possible and in share owner interests, the committee will encourage executive directors to use their leave entitlements, prior to the end of their notice period.

Except in respect of any remaining notice period, no aspect of any executive director’s fixed compensation is payable on termination of employment. Sir Martin Sorrell’s service contract contains an indemnity, subject to certain conditions relating to previously deferred awards, from WPP in respect of any US tax which is charged under section 280G as a result of a termination linked to a change in control of WPP. Further details are set out below.

Short- and long-term compensation elements

If the executive director is dismissed for cause, there is not an entitlement to a STIP award, and any unvested share-based awards will lapse. Otherwise, the table below summarises the relevant provisions from the directors’ service contracts (cash bonus) and the plan rules (RSP, EPSP and LEAP III), which apply in other leaver scenarios. As noted within Notes to the policy table, the committee has the authority to ensure that any awards that vest or lapse are treated in accordance with the plan rules, which are more extensive than the summary set out in the table below.

Plan rules

| Cash bonus |

The executive directors are entitled to receive their bonus for any particular year provided they are employed on the last date of the performance period. |

| ESA |

Provided the executive director is a Good Leaver, unvested awards will be reduced on a time pro-rata basis and paid on the vesting date. |

| EPSP |

- The award will lapse if the executive leaves during the first year of a performance period.

- Provided the executive director is a Good Leaver, awards will vest subject to performance at the end of the performance period and time pro-rating. Awards will be paid on the normal date.

- In exceptional circumstances, the Compensation Committee may determine that an award will vest on a different basis.

- Generally, in the event of death, the performance conditions are to be assessed as at the date of death. However, the committee retains the discretion to deal with an award due to a deceased executive on any other basis that it considers appropriate.

- Awards will vest immediately on a change-of-control subject to performance and time pro-rating unless it is agreed by the committee and the relevant executive director that the outstanding awards are exchanged for equivalent new awards.

|

| LEAP III |

- Awards will vest subject to performance at the end of the performance period and time pro-rating.

- In the event of death or serious illness, the performance conditions are to be assessed as at the date of cessation of employment.

- Awards will vest immediately on a change in control subject to performance and time pro-rating unless the committee decides that awards are to be exchanged for equivalent new awards.

- In the event of a merger, the committee can require participants to release any outstanding award in consideration of the grant of an equivalent award by the newly-formed entity.

|

Other pre-existing terms that apply to Sir Martin Sorrell

- Sir Martin Sorrell’s deferred LEAP awards and his DSUs (as set out above) will be paid out unconditionally on termination of employment. The performance requirements in respect of these awards have already been met, the awards have vested and are therefore no longer subject to any leaver provisions.

- In the event any payments due to Sir Martin would be treated as ‘deferred compensation’ in accordance with US legislation and subject to section 409A requirements, those payments will be delayed. If those payments are delayed, an amount in respect of interest as a result of the delay will be due from the Company to Sir Martin.

- In the event of a change of control of WPP, the Company has agreed to indemnify Sir Martin, with the prior approval of share owners, with respect to any related personal US tax liability under the provisions of section 280G. This indemnity is subject to certain limitations that exempt the Company from liability for any tax related to the share-owner approved deferrals of certain awards. Based on the most recent review by the committee in December 2013 of the potential impact of this clause, it is unlikely that any 280G payment would be due from the Company based on an analysis, using standard assumptions. This was reviewed by independent counsel.

Other committee discretions not set out above

- Leaver status: the committee has the discretion to determine an executive’s leaver classification in light of the guidance set out within the relevant plan rules, except with respect to Sir Martin Sorrell. Unless Sir Martin Sorrell is terminated for cause, he will be treated as having retired on leaving the Company and therefore be treated in accordance with the plan rules as a Good Leaver.

- Compromise agreements: the committee is authorised to reach compromise agreements with departing executives, informed by the default position set out above.

External appointments

Executive directors are permitted to serve as non-executives on the boards of other organisations. If the Company is a share owner in that organisation, non-executive fees for those roles are waived. However, if the Company is not a share owner in that organisation, any non-executive fees can be retained by the office holder.

Executive Remuneration Policy table – chairman and non-executive directors

The following table sets out details of the ongoing compensation elements for WPP’s chairman and non-executive directors. No element of pay is performance-linked.

Details of the ongoing compensation elements for WPP's chairman and non-executive directors

| Component and purpose |

Operation |

Maximum annual opportunity |

Base fees

To reflect the skills and experience and time required to undertake the role. |

Fees are reviewed at least every two years and take into account the skills, experience and time required to undertake the role, as well as fee levels in similarly-sized UK companies.

The chairman and non-executive directors receive a 'base fee' in connection with their appointment to the Board. |

An overall cap on all non-executive fees, excluding consultancy fees, will apply consistent with the prevailing and share owner-approved limit in the Articles of Association (which, due to share owner approval at the 2014 AGM, is £3m). |

Additional fees

To reflect the additional time required in any additional duties for the Company. |

Non-executive directors are eligible to receive additional fees in respect of serving as:

- Senior independent director

- Chairman of a Board Committee

- Member of a Board Committee

- Consultancy fees in respect of other work that falls outside the remit of their role for the Company.

|

An overall cap on all non-executive fees, excluding consultancy fees, will apply consistent with the prevailing and share owner-approved limit in the Articles of Association (which, due to share owner approval at the 2014 AGM, is £3m).

Consultancy fees will be set on a discretionary basis, taking account of the nature of the role and time required. |

Benefits and allowances

To enable the chairman and non-executive directors to undertake their roles. |

The Company will reimburse the chairman and non-executive directors for all reasonable and properly documented expenses incurred in performing their duties of office.

In the event that the reimbursement of these expenses gives rise to a personal tax liability for the chairman or non-executive director, the Company retains the discretion to meet this cost (including, where appropriate, costs in relation to tax advice and filing).

While not currently offered, the Company retains the discretion to pay additional benefits to the chairman including, but not limited to, use of car, office space and secretarial support. |

Benefits and allowances for the chairman will be set at a level that the committee feels is required for the performance of the role. |

Other chairman and non-executive director policies

Letters of appointment for the chairman and non-executive directors

Letters of appointment have a two-month notice period and there are no payments due on loss of office.

Appointments to the Board

Letters of appointment will be consistent with the current terms as set out in this Annual Report. The chairman and non-executive directors are not eligible to receive any variable pay. Fees for any new non-executive directors will be consistent with the operating policy at their time of appointment. In respect of the appointment of a new chairman, the committee has the discretion to set fees taking into account a range of factors including the profile and prior experience of the candidate, cost and external market data.

Share ownership guidelines

Non-executive directors are required to accumulate shares

with a value equivalent to one-year’s fees on a post-tax

basis during their tenure.

Payments in exceptional circumstances

In truly unforeseen and exceptional circumstances, the

committee retains the discretion to make emergency

payments which might not otherwise be covered by this

policy. The committee will not use this power to exceed the

recruitment policy limit, nor will awards be made in excess

of the limits set out in the Executive Remuneration Policy

table. An example of such an exceptional circumstance

could be the untimely death of a director, requiring another

director to take on an interim role until a permanent

replacement is found.