When President Obama began the long and difficult process of normalising US relations with Cuba, he took a significant political risk. Half a century of hostility is not easily brought to an end, and many people remain bitterly opposed to any rapprochement with Raúl Castro’s administration.

Politicians, perhaps unfairly, are often accused of not sticking their necks out, for fear of being decapitated by the electorate. Obama, approaching the end of his second term, has no such concerns, but the restoration of ties with Cuba (alongside the nuclear deal with Iran) will shape his legacy and the ongoing identity of the Democratic Party. It is, in other words, a courageous step and, as overseas investors rush to strike deals in Havana, one that is already delivering progress.

If political leaders are wary of risk-taking, the appetite for it in the corporate world is smaller still. Since the collapse of Lehman Brothers in 2008 and the economic crisis and recession that followed, boardrooms have become ultra-conservative in their decision-making. In a world of zero-based budgeting, activist investors and ubiquitous disruption by tech start-ups, there is little encouragement to be bold.

This is a regrettable, if understandable, fact of contemporary corporate life. It is both a reflection of our low-inflation, low-pricing power, low-growth world, and one of the reasons it is proving so hard to break out of it. Calculated risks are necessary for the long-term health of a business, because without them innovation, development and renewal are impossible.

The danger of losing your head notwithstanding, at WPP we are very much in favour of sticking your neck out. Establishing an office in Havana, the day after Washington announced the reopening of the US Embassy last July, no doubt caused palpitations in the internal audit department and red lights to flash all over the risk dashboard. We did much the same in Myanmar three years earlier when sanctions were lifted. It is not beyond the realms of possibility that Iran will become our 113th country of operation in the course of the next year or so.

For some these are risky moves. We see them as market leadership.

It is all too easy to construct an argument for holding your current position. It is much harder to step out of line or do something unexpected. WPP has never had a motto, and ‘30 years of sticking our neck out’ would be a deeply unwise temptation to Fate. But it has been a solid guiding principle.

It is all too easy to construct an argument for holding your current position. It is much harder to step out of line or do something unexpected

From WPP’s entrepreneurial beginnings, with two people in one room and a stake in a manufacturer of wire baskets and teapots, to the acquisition of J. Walter Thompson and Ogilvy & Mather, the consolidation of media buying under Mindshare and later GroupM, the identification of the digital and data revolutions to come, and our unique, cross-Group, ‘horizontal’ approach to serving clients, the Company’s story has been one of doing things differently.

WPP was the first in our industry to publish a corporate responsibility report. Twenty-two years ago we launched the Atticus Awards and Atticus Journal to celebrate the best original thinking published by people within the Group, and it remains unique to our business. We were the first (and, still, only) parent company to introduce a graduate recruitment scheme, the Fellowship, which is harder to get into than Harvard Business School.

We were the first to invest in applied technology, and we are the only group with its own data business, Kantar. We have the industry’s only tech ‘unconference’, Stream, described by WIRED magazine as one of the best in the world. We pioneered the ‘Team’ model of global account service, breaking down the barriers between our individual agency networks and disciplines in order to offer clients the best talent and capabilities, no matter where they sit within the Group. And we are alone in making a focus on data, technology and content central to our competitive positioning.

The point is that building a business for the long-term, as we have tried to do at WPP, requires differentiation, innovation and, more often than not, a degree of risk.

The same can be said of brands. Differentiation through advertising and marketing services is the single most powerful means of driving a brand’s growth. A short-term, risk-averse approach based primarily on cost management will harm a brand just as surely as wise investment in marketing will ensure its enduring success.

Leader of the resistance

The good news is that corporate short-termism is facing increasingly organised opposition, led by the world’s most powerful investor.

At the beginning of the year Larry Fink, the chief executive of BlackRock, once again wrote to every company in the S&P 500, along with major European corporations, encouraging them to take a longer-term view of their businesses. The letter began as follows:

“Over the past several years, I have written to the CEOs of leading companies urging resistance to the powerful forces of short-termism afflicting corporate behavior. Reducing these pressures and working instead to invest in long-term growth remains an issue of paramount importance for BlackRock’s clients… as well as for the entire global economy.”

An end to earnings hysteria?

Fink is particularly critical of “today’s culture of quarterly earnings hysteria”, which he describes as “totally contrary to the long-term approach we need”:

“CEOs should be more focused… on demonstrating progress against their strategic plans than a one-penny deviation from their EPS targets or analyst consensus estimates.”

In our own reporting we have always tried to provide the bigger picture – to set out the market context in which we operate and a clear sense of where we are heading

This is music to the ears of every CEO who, sitting in front of analysts and media four times a year, has despaired of the lunacy of extrapolating from one quarter’s numbers a definitive conclusion about the performance, health and future prospects of a company.

According to Fink, it is far more important that a business articulates a long-term strategic narrative, and quarterly earnings reports should be primarily a means of measuring how that business is performing against long-term goals.

In our own reporting we have always tried to provide the bigger picture – to set out the market context in which we operate and a clear sense of where we are heading.

More than half of a typical company’s value is created by activities that will take place in three or more years’ time

In today’s frantic world of instant reaction and instant judgement, however, no company can expect analysts or journalists to thank them for providing a longer ‘Outlook’ section in their results announcement. Filing a story or putting out a note in the next five minutes is more important than where the company will be in five years.

Fink also sits on the advisory board of an initiative launched in 2013 by McKinsey & Company and the Canada Pension Plan Investment Board, called Focusing Capital on the Long Term. Its argument is that “when companies forgo profitable investments to meet quarterly earnings expectations, investors and savers lose potential future returns. And all of us miss out on the benefits of long-term economic growth.”

It highlights research that lays bare the extent of the problem. One survey found that over three-quarters of executives would “take actions to improve quarterly earnings at the expense of long-term value creation.” Another showed that “companies that expressly seek to manage short-term earnings in order to narrowly beat consensus also underperform peers after two years.” Given that more than half of a typical company’s value is created by activities that will take place in three or more years’ time, such short-term focus seems wholly perverse.

To counter this destructive trend, Focusing Capital on the Long Term argues for structures and measures that encourage longer-term behaviour, both in the investment community and in companies’ boardrooms. It is a project WPP (alongside organisations like the Wellcome Trust, Unilever, Barclays, Harvard Business School and Dow Chemical) is happy to support.

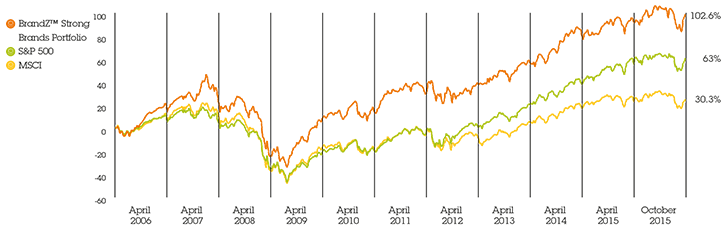

BrandZ™ Portfolio* vs S&P 500 and MSCI World Index 2006-2015

How to beat the market

If I were an independent financial advisor – which, for the sake of clarity (and legality), I should say I am not – I would advise you first to buy shares in WPP, and second to buy shares in those companies with a history of sustained investment in their own brand.

It is abundantly clear, both from external analysis and our own proprietary BrandZ survey, that investing in brands works

According to The Economist, brands “are the most valuable thing that companies as diverse as Apple and McDonald’s own, often worth much more than property and machinery”. WPP’s Millward Brown estimates that brands account for more than 30% of the stock market value of companies in the S&P 500.

It is abundantly clear, both from external analysis and our own proprietary BrandZ survey, that investing in brands works. In the last 10 years, a measurement of the strongest brands from the BrandZ Top 100 as a stock portfolio shows their share price has risen over three times more than the MSCI World Index, a weighted index of global stocks, and substantially outperformed the S&P 500 too.

The world’s most successful investor, Warren Buffett, has consistently backed stocks in the biggest global brands, from IBM to Coca-Cola to American Express. As he said in Berkshire Hathaway’s 2011 Letter to Shareholders: “‘Buy commodities, sell brands’ has long been a formula for business success. It has produced enormous and sustained profits for Coca-Cola since 1886 and Wrigley since 1891.”

Investing in competitive differentiation through marketing communications – as Jeremy Bullmore so eloquently put it, “polishing the apples” – is a prerequisite for a company’s success, especially if it wants to be successful over a long period of time. To quote Jeremy again: “No competitive enterprise, in whatever field of endeavour, can leave its apples unpolished and still expect to win.”

Worldwide communications services expenditure 2015 $m

Worldwide communications services expenditure 2015 $m

| |

Advertising

|

Market research

|

Publicrelations

|

Direct & specialist communications

|

Sponsorship

|

Total

|

|

North America

|

182,847

|

19,200

|

4,210

|

104,105

|

21,400

|

331,762

|

|

Latin America

|

32,261

|

1,960

|

440

|

35,548

|

4,300

|

74,509

|

|

Europe

|

102,915

|

16,400

|

2,600

|

111,722

|

15,300

|

248,937

|

|

Asia Pacific

|

161,856

|

6,400

|

4,700

|

59,213

|

14,000

|

246,169

|

|

Africa & Middle East

|

17,531

|

750

|

151

|

2,082

|

2,500

|

23,014

|

|

Total

|

497,410

|

44,710

|

12,101

|

312,670

|

57,500

|

924,391

|

Polishing WPP's apples

WPP is, of course, itself a brand, and it is important that we continue to differentiate ourselves too – in the eyes of our clients, investors, current and future people and other stakeholders.

In the advertising and marketing services business the traditional points of difference have been talent and price (and their twins, creative effectiveness and efficiency). They remain critical, but we are also increasingly focused on three areas that help WPP and our operating companies to stand apart from our peers: technology, data and content.

For the record, and to pre-empt the howls of protest from traditionalists everywhere: this absolutely does not mean that creativity, in all its forms, is not important anymore (more on that later). It is simply a reflection of the changing nature of our business, of media owners and of the behaviour of the consumers we help brands to reach.

The agnostic ad tech alternative

West Coast giants such as Google and Facebook like to describe themselves as tech companies when in reality they are media owners. For all their eye-catching side projects, such as driverless cars and flying to the moon, their core business is monetising inventory, just like any other media owner.

If anyone doubts that, look at the numbers. The leading recipient of our media spend on behalf of clients is Google, at around US$4 billion in 2015. 21st Century Fox, News Corp and Sky between them amount to US$2.5 billion. Facebook is US$1 billion.

Where the ‘tech’ companies differ from other media owners, though, is in their desire for clients and intermediaries to use their proprietary platforms – principally Google’s DoubleClick and Facebook’s Atlas – to determine where media spend is allocated. Given that they are in business to monetise inventory, they are hardly neutral. You wouldn’t hand your media plan to Rupert Murdoch or Bob Iger, so why hand it to Larry and Sergei or Mark and Sheryl?

We provide an agnostic alternative. Xaxis is WPP’s global digital media platform that programmatically connects advertisers to audiences across all addressable channels. Towards the end of 2014 we injected part of Xaxis (its publisher ad server platform, XFP) into the world’s largest independent ad tech provider, AppNexus. At the same time, we invested $25 million in AppNexus.

As a result, we cemented our leadership position in ad tech and programmatic targeting, while supporting an independent ad tech ecosystem that is of considerably more value to clients than one dominated by the ‘walled garden’ solutions offered by the tech/media behemoths.

In fact, WPP’s focus on ad tech is nothing new – we have long been a leader in the application of technology to marketing. In 2007, WPP was the first company in the sector to invest in applied technology with the acquisition of 24/7 Real Media, which was to become the base on which Xaxis was built. Other companies, like Acceleration (the marketing technology consultancy), Cognifide (which provides content management technology), Salmon (ecommerce agencies) and Hogarth (digital production) are all applying technology to marketing to help clients transact and build relationships with their customers.

We have investments in a number of innovative technology services companies, such as Globant and Mutual Mobile, and in advertising technology companies including eCommera, DOMO, Percolate and Say Media. We were also investors in Buddy Media, Jumptap and Omniture. During the course of the last year we acquired the world’s largest independent media buyer, Essence, and programmatic marketing solutions company The Exchange Lab.

WPP’s focus on ad tech is nothing new – we have long been a leader in the application of technology to marketing

The context for all these changes is, of course, the continued growth of digital channels and advertising. GroupM, our Media Investment Management arm, forecasts net global advertising growth in 2016 of $22 billion, 90% of which will be from digital. This is despite the fact that digital media investment growth in 2016 is expected to be 14%, compared to 17% in 2015, the first deceleration in the post-Lehman recovery. WPP’s digital revenues stand at 37.5% of total turnover and, in line with one of our four strategic objectives, we expect this to grow to between 40% and 45% over the next five years.

With greater digital scale comes greater scrutiny as clients demand more certain guarantees from media owners about the effectiveness of their digital marketing spend. There are increasing concerns, for example, about viewability, fraud and brand safety. In this case WPP acts not only as a neutral intermediary but also as an agent for change in the industry.

GroupM has led the way in championing more stringent standards, based on the hardly unreasonable principle that “our clients should only pay for an ad that is seen by a real human who is in our target in an appropriate editorial environment.”

Data: big, getting bigger

A focus on data and more measurable marketing services is another of our four main strategic priorities. What we once called market research or consumer insight we now describe as Data Investment Management. Contrary to what the resulting acronym might suggest, we think this is not so dim.

This sector of our business has always been about gathering and interpreting information, but the internet has created a new, ever-expanding universe of data, the sheer volume and complexity of which demands ever more sophisticated approaches, tools and techniques.

It also demands a fundamental shift in how we think about the business itself, hence the new definition. Managing clients’ investment in data – in a fragmented, complicated world – is what we do, just as we manage their investment in media. These two areas are increasingly linked within our Group, as we integrate data and media to provide clients with the most telling insights and the best return on their investment.

Some dislike the new terminology (and not only for the admittedly unfortunate abbreviation), because they believe it relegates the role of insight. Not so. Data collection and analysis is nothing, unless it produces actionable insights.

Unearthing and communicating valuable insights remains the core purpose, and the traditional disciplines of market research remain very important in doing that. However, as digital technologies change the world, we need to be at the forefront of new developments. As TNS puts it, “Advances in social media analytics, data flows from connected, ‘internet of things’ devices and many other technological innovations mean that the toolkit the researcher can use to find insights has expanded way beyond the survey.”

Growth of media in major markets 2011-2016 %

| Internet |

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

12.3

|

10.3

|

9.8

|

12.1

|

11.5

|

8.0

|

|

Latin America

|

64.2

|

33.6

|

30.9

|

n/a3

|

54.2

|

25.4

|

|

Western Europe

|

10.9

|

11.4

|

10.0

|

10.7

|

11.1

|

10.6

|

|

Central & Eastern Europe

|

29.1

|

29.3

|

21.9

|

11.7

|

7.6

|

6.1

|

|

Asia Pacific (all)

|

25.8

|

27.3

|

28.7

|

27.8

|

27.2

|

23.3

|

|

North Asia1

|

48.1

|

39.7

|

40.0

|

35.0

|

33.2

|

28.1

|

|

ASEAN2

|

7.3

|

59.8

|

57.1

|

55.6

|

50.4

|

41.3

|

|

Middle East & Africa

|

5.2

|

57.6

|

6.5

|

33.2

|

8.4

|

7.0

|

|

World

|

15.8

|

16.0

|

15.6

|

16.6

|

17.2

|

14.4

|

| Television

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

3.6

|

3.9

|

0.9

|

3.5

|

-0.1

|

2.2

|

|

Latin America

|

6.7

|

11.5

|

14.1

|

8.6

|

6.3

|

5.7

|

|

Western Europe

|

0.8

|

-5.7

|

-0.2

|

3.5

|

2.6

|

3.6

|

|

Central & Eastern Europe

|

10.5

|

2.3

|

3.1

|

3.1

|

-3.4

|

4.0

|

|

Asia Pacific (all)

|

8.0

|

5.9

|

4.5

|

1.4

|

-0.3

|

0.4

|

|

North Asia1

|

11.0

|

5.8

|

3.0

|

-1.8

|

-3.5

|

-4.0

|

|

ASEAN2

|

14.5

|

13.8

|

16.5

|

11.1

|

9.1

|

9.0

|

|

Middle East & Africa

|

5.8

|

13.7

|

7.2

|

2.5

|

4.8

|

5.3

|

|

World

|

5.1

|

4.1

|

3.4

|

3.2

|

0.9

|

2.3

|

| Outdoor

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

2.8

|

3.7

|

3.2

|

0.1

|

2.0

|

1.8

|

|

Latin America

|

10.9

|

19.3

|

-7.2

|

4.5

|

5.7

|

4.3

|

|

Western Europe

|

-1.9

|

-2.3

|

-1.8

|

-0.4

|

2.6

|

2.0

|

|

Central & Eastern Europe

|

7.8

|

3.1

|

2.7

|

-0.6

|

-12.8

|

0.9

|

|

Asia Pacific (all)

|

11.3

|

12.6

|

5.1

|

6.4

|

4.7

|

3.4

|

|

North Asia1

|

23.6

|

18.4

|

6.0

|

8.4

|

5.4

|

3.4

|

|

ASEAN2

|

9.3

|

17.8

|

6.0

|

-3.1

|

-1.8

|

4.0

|

|

Middle East & Africa

|

46.8

|

24.1

|

1.6

|

-0.5

|

3.3

|

5.0

|

|

World

|

7.1

|

7.8

|

2.6

|

3.4

|

3.1

|

2.9

|

| Magazines

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

-0.1

|

1.9

|

0.0

|

-4.3

|

-3.2

|

-0.3

|

|

Latin America

|

10.9

|

3.0

|

-6.5

|

-8.9

|

-9.1

|

-3.8

|

|

Western Europe

|

-2.6

|

-10.7

|

-8.5

|

-5.5

|

-8.0

|

-3.6

|

|

Central & Eastern Europe

|

0.7

|

-4.1

|

-11.6

|

-10.4

|

-19.5

|

-6.7

|

|

Asia Pacific (all)

|

1.5

|

0.3

|

-2.5

|

-8.2

|

-9.3

|

-5.9

|

|

North Asia1

|

13.2

|

4.9

|

-1.7

|

-12.5

|

-16.8

|

-13.3

|

|

ASEAN2

|

4.4

|

-1.9

|

-5.7

|

-10.0

|

-10.5

|

-7.7

|

|

Middle East & Africa

|

2.2

|

-12.3

|

7.7

|

-4.7

|

-0.3

|

2.5

|

|

World

|

-0.1

|

-1.6

|

-2.6

|

-5.3

|

-5.4

|

-1.8

|

|

Radio

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

2.3

|

4.4

|

0.1

|

-3.5

|

-2.0

|

0.5

|

|

Latin America

|

17.5

|

-0.6

|

2.3

|

6.6

|

6.2

|

2.7

|

|

Western Europe

|

1.1

|

-3.6

|

-2.9

|

2.9

|

1.6

|

1.2

|

|

Central & Eastern Europe

|

5.7

|

8.2

|

2.4

|

2.0

|

-5.6

|

2.8

|

|

Asia Pacific (all)

|

3.4

|

5.3

|

-2.5

|

3.5

|

0.0

|

1.8

|

|

North Asia1

|

8.5

|

7.4

|

1.7

|

2.2

|

-2.8

|

0.2

|

|

ASEAN2

|

1.8

|

9.6

|

-26.3

|

6.6

|

5.1

|

5.8

|

|

Middle East & Africa

|

13.9

|

36.8

|

4.7

|

2.4

|

1.6

|

1.4

|

|

World

|

4.0

|

3.9

|

-0.6

|

0.7

|

0.1

|

1.3

|

| Cinema

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

4.8

|

4.5

|

4.3

|

-16.7

|

15.0

|

-5.0

|

|

Latin America

|

7.5

|

-0.5

|

15.2

|

18.7

|

19.9

|

13.2

|

|

Western Europe

|

-0.9

|

3.8

|

-11.0

|

0.4

|

9.6

|

0.7

|

|

Central & Eastern Europe

|

11.4

|

9.5

|

10.3

|

-2.5

|

-3.6

|

4.2

|

|

Asia Pacific (all)

|

2.4

|

11.2

|

-8.0

|

-1.0

|

11.9

|

12.2

|

|

North Asia1

|

3.9

|

0.0

|

4.2

|

4.0

|

0.0

|

0.0

|

|

ASEAN2

|

15.6

|

10.4

|

-25.9

|

-9.3

|

7.0

|

11.1

|

|

Middle East & Africa

|

37.8

|

1.0

|

2.3

|

24.3

|

-0.8

|

10.1

|

|

World

|

2.9

|

5.0

|

-5.6

|

3.3

|

10.0

|

5.6

|

|

Newspapers

|

2011

|

2012

|

2013

|

2014

|

2015f

|

2016f

|

|

North America

|

-6.6

|

-4.8

|

-4.0

|

-5.9

|

-7.3

|

-6.5

|

|

Latin America

|

3.7

|

16.6

|

-6.9

|

-3.7

|

-0.3

|

-3.6

|

|

Western Europe

|

-2.3

|

-9.8

|

-10.0

|

-5.4

|

-7.3

|

-5.6

|

|

Central & Eastern Europe

|

1.8

|

-1.2

|

-8.8

|

-9.0

|

-8.2

|

-4.5

|

|

Asia Pacific (all)

|

0.2

|

-2.6

|

-2.9

|

-8.3

|

-10.4

|

-6.1

|

|

North Asia1

|

3.7

|

-5.2

|

-5.1

|

-15.2

|

-22.8

|

-19.3

|

|

ASEAN2

|

5.9

|

1.4

|

8.2

|

-7.3

|

-6.2

|

-1.5

|

|

Middle East & Africa

|

-1.6

|

-4.8

|

0.2

|

-6.7

|

-8.0

|

-2.0

|

|

World

|

-2.5

|

-4.6

|

-5.4

|

-6.5

|

-7.9

|

-5.7

|

One manifestation of this new reality is Kantar’s partnership with Twitter to provide real-time social TV data, since expanded to a broader collaboration on new research products in the areas of advertising effectiveness, consumer insight, brand equity, customer satisfaction and media measurement. Others include the sophisticated social media analysis engine behind TNS’s social products, and our partnerships and investments with both comScore (known primarily for its web measurement capabilities) and Rentrak (the leader in TV set-top box data), which have now come together.

WPP supported the comScore-Rentrak merger and now holds 18.6% of the combined entity. With the growth of out-of-home and multiscreen viewing, and the changes in millennial and centennial media consumption habits, clients and media owners want better measurement. The industry is crying out for a stronger currency and comScore and Rentrak will help to provide it.

Time spent per adult user per day with digital media USA 2008 vs 2015

- Mobile

- Desktop/Laptop

- Other connected devices

My crown is call'd content

I imagine there are still people in our industry whose LinkedIn profiles don’t include the word ‘content’ but they are surely becoming a minority. The term may be faddish and frequently abused (see the subheading above), but its ubiquity does reflect a very important trend.

The public has always had a huge appetite for quality content, and digital platforms have only intensified that hunger. At the same time, the changing dynamics of the market mean that the traditional producers of such content have been joined by many other kinds of producer – from consumers themselves to web start-ups, advertisers and agencies.

WPP has placed itself at the centre of these changes, not only through the diversified services offered by our operating companies but also through strategic investments in exciting content businesses.

Five years ago, for example, we invested $36 million in Vice Media, the global youth media brand. Today our stake is worth some $300 million as the digitally-led Vice brand attracts readers, viewers, advertisers and investors in ever greater numbers.

The public has always had a huge appetite for quality content, and digital platforms have only intensified that hunger

Our other content investments include Media Rights Capital (producer of Netflix smash hit House of Cards); Refinery29 (the fashion and lifestyle site aimed at millennial women, and one of the fastest growing media companies in the US); Fullscreen (the multiplatform youth network with more than 600 million subscribers and five billion monthly views); China Media Capital (China’s first sovereign private equity fund dedicated to media and entertainment sector investment); Indigenous Media (the next-generation digital content studio founded by acclaimed film-makers Jon Avnet, Rodrigo Garcia and Jake Avnet); The Weinstein Company (the studio behind The Hateful Eight, Django Unchained and The King’s Speech); Imagine Entertainment (headed by Brian

Grazer and Ron Howard, the producers behind A Beautiful Mind and Empire); and a joint venture with award-winning producer, songwriter and director Alex Da Kid.

We have also focused on the rapidly-growing sector of sports content and sports marketing. In 2015, WPP led a syndicate investing US$250 million in Bruin Sports Capital, a global sports marketing firm launched by George Pyne, the former president of IMG Worldwide’s global sports and entertainment business. And at the beginning of this year we backed an investment by Bruin in Courtside Ventures, a venture capital fund that specialises in sports-related, early-stage technology and media companies.

In addition, during the last year GroupM launched ESP Properties, a commercial and creative advisor to sports and entertainment rights holders, which counts iconic organisations such as the All Blacks and Cleveland Cavaliers among its growing client list. They join the large number of premium sports organisations and properties already working with WPP operating companies, such as the IOC, UEFA, Premier League, La Liga, F1, Manchester United, City Football Group, NASCAR, NBA, PAC-12, the NFL and Brazilian football legends Ronaldo and Pelé.

A team of all the talents?

In the Reports from our company leaders section of this report is a wonderful piece of art by Peter Blake, featuring our own Ronaldos and Pelés – the team of stars who run WPP’s global operating company networks.

It underlines the fact that WPP is an organisation driven by talent. David Ogilvy’s famous remark about his agency that “the assets go up and down the elevator every day” is just as true today of WPP. To describe us as a “people business” is no empty cliché: our biggest investment is in people – over $10 billion a year, or 54% of total revenues.

Our long-standing mission statement is: “To develop and manage talent; to apply that talent, throughout the world, for the benefit of clients; to do so in partnership; to do so with profit.” This philosophy applies at every level within WPP and its operating companies. As exalted as they are, the 67 executives shown in the centrefold are merely the representatives of the great army of talented, creative people responsible for our collective success.

As in many sectors, women continue to be under-represented in the top jobs in our industry

Our commitment to developing that talent, laid out in detail in our Sustainability Report, is broad and deep, but it would be remiss of me not to acknowledge one area where we still have work to do.

As brilliant as it is, the Blake artwork has a flaw, and that is the lack of diversity on display – both in terms of gender and national and ethnic background. As the fast-growth markets of Asia Pacific, Latin America, Africa, the Middle East and Central and Eastern Europe become a larger part of our business, I would expect the make-up of our senior management team to change accordingly over time. This inevitable geographic shift clearly won’t provide all of the solution (again, our Sustainability Report covers our approach in detail), but it will be part of it. The gender question may be more difficult.

As in many sectors, women continue to be under-represented in the top jobs in our industry, and WPP is no exception. In some ways it’s going to get harder still, because marketing services are becoming more influenced by digital, data and technology – fields in which achieving gender balance has been even tougher.

Below the very highest level, the picture is a little brighter: women now make up 33% of executive leaders within our operating companies and 47% of senior managers. But there’s clearly a long way to go.

Within our companies we operate various schemes to help the development of female leaders, including training, raising awareness of unconscious bias, networking, sponsorship and mentoring programs. Examples include Team Detroit’s recently launched ‘Returnship’ program, which gives women the chance to restart their careers and is designed to increase the number of women in leadership positions.

Companies with greater gender balance in their leadership teams outperform their peers

There are also many external-facing initiatives, such as J. Walter Thompson’s Female Tribes, a new, proprietary study about women around the world, and an associated documentary the agency co-produced for the BBC called Her Story: The Female Revolution.

At Group level we have schemes such as The X Factor, a mentoring and development program for senior women run by Charlotte Beers, the former CEO of Ogilvy & Mather and chairman of J. Walter Thompson. This has recently been supplemented by Women In Leadership Lessons, again led by Charlotte, for those currently in mid-level management roles.

In the UK, WPP Stella is a network that supports efforts to achieve gender balance and encourages the sharing of best practice between our companies. We aim to roll it out in other markets soon. WPP also supports Women On Boards, which encourages women to take on non-executive board roles across a range of private and public organisations.

The business imperative for improving our record is crystal clear: companies with greater gender balance in their leadership teams outperform their peers.We will renew our efforts in this critical area over the coming year, particularly given recent events.

Staying creative, effective and relevant

For the last five years WPP has been named the world’s most creative holding company at the Cannes Lions International Festival of Creativity. Just as importantly, perhaps more so, we have also won the Effie for most effective holding company in each of the last four years. And this year, for the second time in a row, WPP was named the top-performing parent company in the highly regarded Warc 100 ranking, which reflects our agencies’ success in strategy and effectiveness competitions around the world.

Together this trio of awards is the perfect endorsement of our people’s collective abilities, and the perfect encapsulation of what we deliver for clients: creative effectiveness.

But every company and every industry needs to develop

constantly to maintain success. Cannes has recognised

this and, responding to the stark fact that, very recently,

only 3% of creative directors were women, has made

gender diversity a key theme of its annual event.

From whichever angle you look at it, it’s an unacceptable statistic. It’s also one that runs counter to our own commercial interests. Women account for 60% of university graduates and are responsible for 80% of consumer purchasing decisions, so it damages our access to both talent and markets.

If the advertising and marketing services business wants to remain relevant, and to carry on producing the best, most creative and most effective work for clients, it needs to prioritise tackling these issues and support the efforts of organisations like Cannes.

BrandZ™ Top 10 most valuable Chinese brands 2016

|

Rank

|

Brand

|

Category

|

Brand value 2016 $m

|

Year-on-year change

|

| 1 |

Tencent

|

Technology

|

82,107

|

24%

|

| 2 |

China Mobile

|

Telecoms

|

57,157

|

2%

|

| 3 |

Alibaba

|

Retail

|

47,605

|

-20%

|

| 4 |

ICBC

|

Banks

|

34,276

|

-1%

|

| 5 |

Baidu

|

Technology

|

26,849

|

-13%

|

| 6 |

China Construction Bank

|

Banks

|

19,270

|

-6%

|

| 7 |

Huawei

|

Technology

|

18,501

|

NEW

|

| 8 |

Agricultural Bank of China

|

Banks

|

16,239

|

5%

|

| 9 |

Ping An

|

Insurance

|

15,624

|

41%

|

| 10 |

China Life

|

Insurance

|

15,504

|

53%

|

Clients under pressure

Those clients are under increasing pressure as the global economy faces what former US Treasury Secretary Larry Summers and the International Monetary Fund have described as “secular stagnation”, a long-term slump in the growth of economic output. Mega mergers such as DuPont and Dow, or AB InBev and SABMiller, reflect this, as companies find top-line growth elusive and instead look to efficiencies of scale.

Boards are being squeezed by a triumvirate consisting of zero-based budgeters like 3G, Valeant and Endo, activist investors like Nelson Peltz, Bill Ackman and Dan Loeb, and disruptors like Airbnb and Uber.

At the same time, the slowdown in the BRICs and other fast-growth countries has dented confidence across the world’s markets, which had a rocky start to 2016, to say the least. However, certainly in the context of our business, I expect these markets to bounce back over the medium- to long-term as the explosion in the number of lower-middle- and middle-class consumers continues unabated.

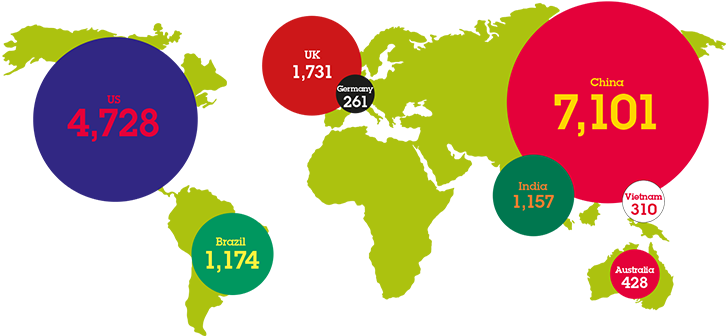

Although China will continue to be volatile, I remain a raging Chinese bull over the long term. India is currently the jewel in the fast-growth crown and markets like Vietnam, the Philippines, Indonesia and Colombia continue to prosper. Increasing the proportion of our revenues from faster-developing markets to 40-45% of the total over the next five years remains one of our core strategic priorities.

Nonetheless, it seems highly unlikely that global GDP growth will escape the doldrums any time soon. We may be stuck with a slower-growth world for a while yet.

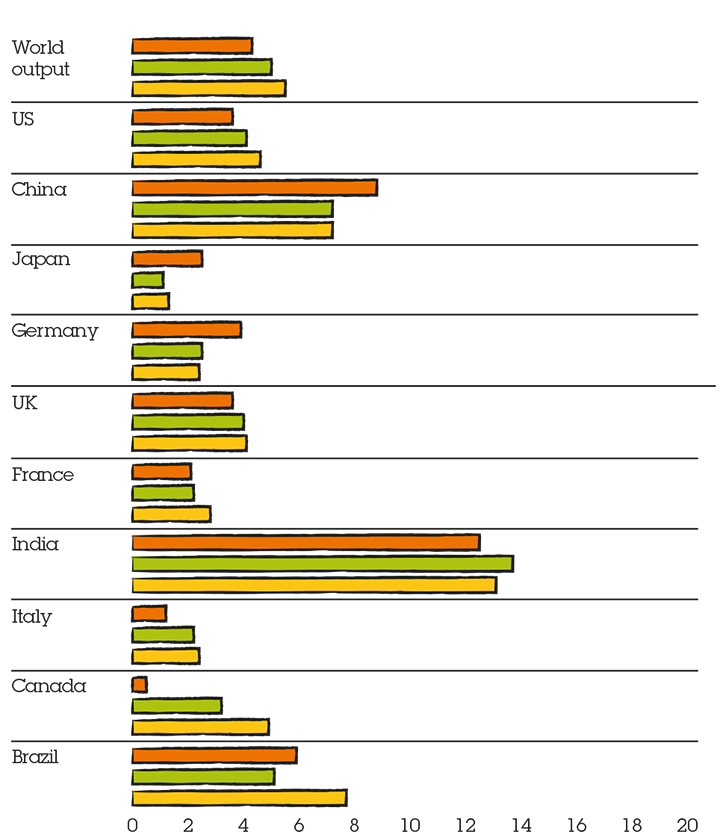

Shape of global recovery

- Advertising

- Global nominal GDP

Contributions to 2016 media growth by countryf $m

Contributions to 2016 media growth by countryf

| |

Contribution

$m

|

Contribution

%

|

|

Asia Pacific (all)

|

11,536

|

51.6

|

|

NORTH ASIA

|

7,563

|

33.8

|

|

China

|

7,101

|

31.8

|

|

NORTH AMERICA

|

4,767

|

21.3

|

|

US

|

4,728

|

21.1

|

|

WESTERN EUROPE

|

3,121

|

14.0

|

|

LATIN AMERICA

|

1,914

|

8.6

|

|

UK

|

1,731

|

7.7

|

|

Brazil

|

1,174

|

5.2

|

|

India

|

1,157

|

5.2

|

|

ASEAN

|

1,119

|

5.0

|

|

Japan

|

1,110

|

5.0

|

|

MIDDLE EAST & AFRICA

|

650

|

2.9

|

|

Philippines

|

507

|

2.3

|

|

Australia

|

428

|

1.9

|

|

CENTRAL & EASTERN EUROPE

|

375

|

1.7

|

|

Vietnam

|

310

|

1.4

|

|

GCC and Pan Arab*

|

297

|

1.3

|

|

Spain

|

280

|

1.3

|

|

Germany

|

261

|

1.2

|

|

Mexico

|

221

|

1.0

|

|

Greece

|

217

|

1.0

|

|

Colombia

|

207

|

0.9

|

|

South Korea

|

197

|

0.9

|

Nominal GDP projections 2015-2017f

A prescription for global ills

Last year, under the auspices of the Turkish G20 presidency, a new business group was established to support the G20’s efforts to build confidence in the global economy. The B20 (Business 20) International Business Advisory Council, chaired by Coca-Cola’s Muhtar Kent and backed by a range of companies including WPP, was set up to enhance dialogue between the corporate world and governments. It made four recommendations.

The first was that governments should ratify and implement the World Trade Organization’s Trade Facilitation Agreement to remove red tape and delays when moving goods across borders. The second priority was to improve access to finance for SMEs, which are disproportionately affected by adverse credit market conditions.

The third was to ask the G20 to commit to a comprehensive strategy to boost youth and female participation in the workforce, not least through better public-private collaboration on national skills strategies and education plans. Finally, the B20 said that the world’s leading economies must articulate coherent national strategies to attract the huge levels of private investment needed to plug the global spending gap on infrastructure.

To the B20’s four I would also add a fifth: collaboration between businesses, and between businesses and governments, to support the United Nations’ Sustainable Development Goals (SDGs), the ambitious targets “to end poverty, protect the planet, and ensure prosperity for all.” WPP has been working with the UN to support the SDGs, with a focus on fostering such partnerships, and this will be a key project for the Group in 2016.

The united nations of WPP

In WPP’s early days I doubt even the UN could have persuaded our companies to put down their cudgels and work together, but happily they have now discovered that peaceful co-existence and cooperation is not only possible, but very fruitful.

Getting our 190,000 people (including associates) to collaborate as seamlessly as possible across company, functional and national boundaries for the benefit of clients is our fourth and final core strategic priority. We call this ‘horizontality’ – an ugly word for an increasingly effective way of working.

Peaceful co-existence and cooperation is not only possible, but very fruitful

We have been pursuing this strategy for some time, largely in response to demand from clients. Our biggest client, Ford, has been served through a dedicated cross-Group team since 2006. We now have 45 such teams, responsible for over a third of WPP’s revenues and involving nearly 40,000 of our people, working for clients as diverse as American Express, Unilever, Coca-Cola, IBM and News Corp. Team wins in the last year included Emirates, General Mills and Bayer.

For the first time our Annual Report has a section devoted to our Global Client Teams, featuring a collage of all their leaders (almost half of whom, it is encouraging to note, are women).

As well as the client teams we have 17 Country Regional and Sub-Regional Managers, covering 51 out of the 112 countries in which we operate. Their job is to encourage horizontality to deliver the best resources to clients, identify acquisition opportunities and help recruit the best talent locally.

At least one of WPP’s global competitors has finally woken up to this approach, announcing, late last year amidst a broader reorganisation, the creation of ‘chief client officers’. It also signalled its intention to bring together its media agencies to leverage their collective scale, something WPP did under GroupM more than a decade ago. Flattery, indeed.

Back to politics, and risk

In geopolitics, togetherness is harder to find. In the coming year, deeply divisive political events will dominate news coverage in our two biggest markets.

In the US the ‘reality TV’ Presidential election is rocking the Establishment, on both sides of the party divide. In the UK, against the backdrop of the ongoing migrant crisis, the electorate will decide whether or not the country should remain in the European Union. Both could have a significant economic impact.

In each case, voters face a choice between a riskier and a safer option. Brexit will bring uncertainty for business and, potentially, real damage to the UK economy. Populism and protectionism in the White House is not a recipe for economic success. For once, a cautious approach may be no bad thing.

The interests of our people, clients and investors are best served when we embrace

calculated risk-taking

At WPP, however, we hold to the view that the interests of our people, clients and investors are best served when we embrace calculated risk-taking. We will continue to stick our neck out on their behalf.

10 key trends

1. Power is shifting South, East and South-East

New York is still the centre of the world, but power (economic, political and social) is becoming more widely distributed, marching South, East and South-East: to Latin America, India, China, Russia, Africa & Middle East and Central & Eastern Europe. Although growth rates in these markets have slowed, the underlying trends persist as economic development lifts millions into lives of greater prosperity, aspiration and consumption.

2. Supply exceeds demand – except in talent

Despite the global financial crisis, manufacturing production still generally outstrips consumer demand. This is good news for marketing companies, because manufacturers need to invest in branding in order to differentiate their products from the competition.

Meanwhile, the war for talent, particularly in traditional Western companies, has only just begun. The squeeze is coming from two directions: declining birth rates, smaller family sizes and urban concentration; and the relentless rise of the web and associated digital technologies. Simply, there will be fewer entrants to the jobs market and, when they do enter it, young people expect to work for tech-focused, more networked, less bureaucratic companies. It is hard to recruit the right talent now; it will be harder in 20 years.

Economic development lifts millions into lives of greater prosperity, aspiration and consumption

3. Changing dynamics in retail

For the last 20 years or so the big retailers like Walmart, Tesco and Carrefour have had a lot more power than manufacturers, because they deal directly with consumers at the point of sale and who have been accustomed to visiting their often big box stores. This won’t change overnight, but manufacturers can now have direct relationships with consumers via the web and e-commerce platforms in particular, at the same time as city dwellers (already 50% of the population, soon to be 70%), demand proximity retailing – smaller, more convenient stores. However, unless manufacturers move quickly, there is a danger that Amazon or Alibaba or Flipkart will become the new Walmart or Tesco.

4. Internal communications has grown up

Once an unloved adjunct to the HR department, internal communications has moved up the food chain and enlightened leaders now see it as critical to business success. One of the biggest challenges facing any chairman or CEO is how to communicate strategic and structural change within their own organisations. The prestige has traditionally been attached to external communications, but aligning internal constituencies is at least as important, and arguably more than half of our business.

Unless manufacturers move quickly, there is a danger that Amazon or Alibaba or Flipkart will become the new Walmart or Tesco

5. Disintermediation

An ugly word, with even uglier consequences for those who fail to manage it. It’s the name of the game for web giants like Apple, Google, Amazon and Alibaba, which have removed large chunks of the supply chain (think music retailers, business directories and bookshops) in order to deliver goods and services to consumers more simply and at lower cost.

Take our ‘frienemy’ Google: our biggest media trading partner at $4 billion out of $73 billion of billings in 2015 and, at the same time, one of our main rivals, too. Xaxis and AppNexus face off against Google and DoubleClick. It’s a formidable competitor that has grown very big indeed by – some say – eating everyone else’s lunch, but marketing services businesses have a crucial advantage.

Google (like Facebook, Twitter, LinkedIn and others) is not a neutral intermediary, but a media owner. It sells its own inventory on its own platform. We, however, are independent, meaning we can give disinterested, platform-agnostic advice to clients. You wouldn’t hand your media plan to News Corporation or Viacom and let them tell you where to spend your advertising dollars and pounds, so why hand it to Google, Facebook and co?

Global public internet companies’ market capitalisation 1995 vs 2015

$bn

| |

Company

|

Country

|

Market cap $bn

|

|

1

|

Netscape

|

USA

|

5,415

|

|

2

|

Apple

|

USA

|

3,918

|

|

3

|

Axel Springer

|

Germany

|

2,317

|

|

4

|

RentPath

|

USA

|

1,555

|

|

5

|

Web.com

|

USA

|

982

|

|

6

|

PSINet

|

USA

|

742

|

|

7

|

Netcom On-Line

|

USA

|

399

|

|

8

|

IAC/Interactive

|

USA

|

326

|

|

9

|

Copart

|

USA

|

325

|

|

10

|

Wavo Corporation

|

USA

|

203

|

|

11

|

iStar Internet

|

Canada

|

174

|

|

12

|

Firefox Communications

|

USA

|

158

|

|

13

|

Storage Computer Corp.

|

USA

|

95

|

|

14

|

Live Microsystems

|

USA

|

86

|

|

15

|

iLive

|

USA

|

57

|

| |

Total market cap of top 15

|

|

$16,752

|

| |

Company

|

Country

|

Market cap $bn

|

|

1

|

Apple

|

USA

|

763,567

|

|

2

|

Google

|

USA

|

373,437

|

|

3

|

Alibaba

|

China

|

232,755

|

|

4

|

Facebook

|

USA

|

226,009

|

|

5

|

Amazon.com

|

USA

|

199,139

|

|

6

|

Tencent

|

China

|

190,110

|

|

7

|

eBay

|

USA

|

72,549

|

|

8

|

Baidu

|

China

|

71,581

|

|

9

|

Priceline Group

|

USA

|

62,645

|

|

10

|

Salesforce.com

|

USA

|

49,173

|

|

11

|

JD.com

|

China

|

47,711

|

|

12

|

Yahoo!

|

USA

|

40,808

|

|

13

|

Netflix

|

USA

|

37,700

|

|

14

|

LinkedIn

|

USA

|

24,718

|

|

15

|

Twitter

|

USA

|

23,965

|

| |

Total market cap of top 15

|

$2,415,867

|

6. Global and local up, regional down

The way our clients structure and organise their businesses is changing. Globalisation continues apace, making the need for a strong corporate centre even more important. Increasingly, though, what CEOs want is a nimble, much more networked centre, with direct connections to local markets – how can the centre know what is really going on in more than 100 or 200 countries? This also hands greater responsibility and accountability to local managers, and puts pressure on regional management layers that act as a buffer, preventing information from flowing upwards or downwards and stopping things from happening. After all, our local people know who are the good people, the growing companies and the best acquisitions and investments.

What CEOs want is a nimble, much more networked centre, with direct connections to local markets

7. Number-crunchers have too much clout

Some companies seem to think they can cost-cut their way to growth. This misconception is increasingly a post-Lehman phenomenon: corporates still bear the mental scars of the crash, and conservatism rules. But there’s hope: finance will only hold sway over the chief marketing officers in the short term. There’s a limit to how much you can cut, but top-line growth (driven by investment in marketing) is infinite, at least until you reach 100% market share.

Finance will only hold sway over the chief marketing officers in the short term

8. Bigger government

Governments are becoming ever more important – as regulators, investors and clients. Following the global financial crisis and ensuing recession, governments have had to step in and assert themselves – just as they did during and after the Great Depression in the 1930s and 1940s. And they are not going to retreat any time soon.

Administrations need to communicate public policy to citizens, drive health initiatives, recruit people, promote their countries abroad, encourage tourism and foreign investment, and build their digital government capabilities. All of which require the services of our industry.

9. Sustainability is no longer ‘soft’

The days when companies regarded sustainability as a bit of window-dressing (or, worse, a profit-sapping distraction) are long gone. Today’s business leaders understand that social responsibility goes hand-in-hand with sustained growth and profitability. Doing good is good business. Business needs permission from society to operate, and virtually every CEO recognises that you ignore stakeholders at your peril – if you’re trying to build brands for the long term.

10. Industry consolidation

As a result of all this, we expect consolidation to continue – among clients, media owners and marketing services agencies. This consolidation takes many forms, including the Bolloré model which consolidates ownership of telecommunications and media with an agency. Bigger companies will have the advantages of scale, technology and investment, while those that remain small will have flexibility and a more entrepreneurial spirit on their side. In this low-growth, low-inflation, low-pricing power world, where top-line expansion is hard to come by, boards and investors increasingly turn to mergers and acquisitions. In this environment the activist investors like Nelson Peltz, Bill Ackman and Dan Loeb seem to have had remarkable success in 2015 (e.g. Dow and Dupont, AB InBev and SABMiller). At WPP, we’ll continue to play our part by focusing on small-and medium-sized strategic acquisitions and investments (52 of them in all in 2015).