Financial summary

Financial Summary

| |

2015 |

2014 |

Change % |

|

Billings1

|

£47,632m

|

£46,186m

|

+3.1

|

|

Revenue

|

£12,235m

|

£11,529m

|

+6.1

|

|

Net sales1

|

£10,524m

|

£10,065m

|

+4.6

|

|

Headline EBITDA2

|

£2,002m

|

£1,910m

|

+4.9

|

|

Headline operating profit2

|

£1,705m

|

£1,611m

|

+5.8

|

|

Reported operating profit

|

£1,632m

|

£1,507m

|

+8.3

|

|

Headline PBIT2

|

£1,774m

|

£1,681m

|

+5.6

|

|

Net sales margin2

|

16.9%

|

16.7%

|

+0.2*

|

|

Headline PBT2

|

£1,622m

|

£1,513m

|

+7.3

|

|

Reported PBT

|

£1,493m

|

£1,452m

|

+2.8

|

|

Headline earnings2

|

£1,229m

|

£1,136m

|

+8.2

|

|

Reported earnings

|

£1,160m

|

£1,077m

|

+7.7

|

| |

|

|

|

|

Headline diluted earnings per share2,3

|

93.6p

|

84.9p

|

+10.2

|

|

Reported diluted earnings per share3

|

88.4p

|

80.5p

|

+9.8

|

|

Ordinary dividend per share

|

44.69p

|

38.20p

|

+17.0

|

|

Ordinary dividend per ADR4

|

$3.42

|

$3.15

|

+8.6

|

| |

|

|

|

|

Net debt at year-end

|

£3,211m

|

£2,275m

|

+41.1

|

|

Average net debt5

|

£3,562m

|

£3,001m

|

+18.7

|

|

Ordinary share price at year-end

|

1,563.0p

|

1,345.0p

|

+16.2

|

|

ADR price at year-end

|

$114.74

|

$104.10

|

+10.2

|

|

Market capitalisation at year-end

|

£20,237m

|

£17,831m

|

+13.5

|

| |

|

|

|

|

At 14 April 2016

|

|

|

|

|

Ordinary share price

|

1,656.0p

|

|

|

|

ADR price

|

$117.38

|

|

|

|

Market capitalisation

|

£21,423m

|

|

|

Revenue £m

Reported revenue was up 6.1% at £12,235 million. On a constant currency basis, revenue was up 7.5% and, on a like-for-like basis, revenue was up 5.3%.

Net sales £m

Reported net sales were up 4.6% at £10,524 million.

On a constant currency basis, net sales were up 5.8%

and, on a like-for-like basis, net sales were up 3.3%.

Headline PBIT1 £m

Headline PBIT was up 5.6% to £1,774 million. Net sales margin was up 0.2 margin points (0.4 margin points on

a constant currency basis) to an industry-leading 16.9%.

Headline EBITDA1 £m

Headline EBITDA (headline earnings before interest, taxation, depreciation and amortisation) rose

by 4.9% (7.7% in constant currencies), crossing

£2 billion for the first time.

Return on equity2 %

- Weighted average cost of capital (WACC)

16.3%

Return on equity increased to 16.3% in 2015, while the weighted average cost of capital rose to 6.7%.

Headline diluted earnings per share1 p

Headline diluted earnings per share were up 10.2% to 93.6p. Dividends were up 17.0% to 44.69p per share, giving a payout ratio of 47.7% compared with 45.0%

in 2014.

Average net debt £m

- Average net debt to headline EBITDA2 ratio

3,562m

Average net debt was up at £3.6 billion in 2015, reflecting incremental spend on acquisitions, share buy-backs and dividends. The average net debt to headline EBITDA ratio increased to 1.8 times, in the middle of the Group’s target range of 1.5-2.0 times.

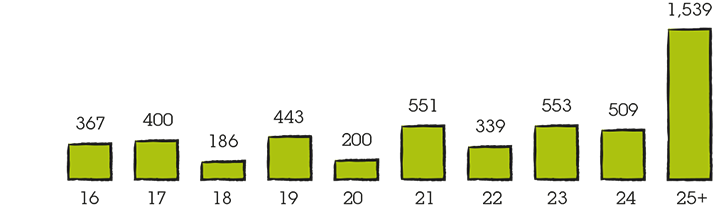

Debt maturity3 £m

The Group continues to work to achieve continuity and flexibility of funding. Undrawn committed borrowing facilities are maintained in excess of peak net-borrowing levels and debt maturities are monitored closely.

2015 revenue by geography %

- North America37

- UK14

- Western Continental Europe20

- Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe29

In 2015, 29% of the Group’s revenue came from Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe. Our target is to increase this to 40-45% of revenues over the next five years.

2015 headline PBIT1 by geography %

- North America41

- UK14

- Western Continental Europe15

- Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe30

Profit growth was strongest in North America in 2015,

with margins of almost 19%.

2015 revenue by sector %

- Advertising and Media Investment Management45

- Data Investment Management20

- Public Relations & Public Affairs8

- Branding & Identity, Healthcare and Specialist Communications27

Marketing services comprised 55% of our revenues in 2015, a little less than 2014. Revenue growth was strongest in Advertising and Media Investment Management at almost 10% in constant currencies.

2015 headline PBIT1 by sector %

- Advertising and Media Investment Management48

- Data Investment Management16

- Public Relations & Public Affairs9

- Branding & Identity, Healthcare and Specialist Communications27

PBIT contributions were broadly in line with prior year,

with Data Investment Management and Public Relations

& Public Affairs showing significant margin growth.