Financial summary

Financial Summary

| |

2014 |

2013 |

Change % |

|

The financial statements have been prepared under International Financial Reporting Standards (IFRS).

1 Billings and net sales are defined on page 238 of the financial statements PDF (1.19MB).

2 The calculation of ‘headline’ measurements of performance (including headline EBITDA, headline operating profit, headline PBIT, net sales margin, headline PBT and headline earnings) is set out in note 31 of the financial statements PDF (1.19MB).

3 One American Depositary Receipt (ADR) represents five ordinary shares. These figures have been translated for convenience purposes only using the Consolidated income statement exchange rates shown on page 190 of the financial statements PDF (1.19MB). This conversion should not be construed as a representation that the pound sterling amounts actually represent, or could be converted into, US dollars at the rates indicated.

4 Earnings per share is calculated in note 9 of the financial statements PDF (1.19MB).

5 Average net debt is defined on page 238 of the financial statements PDF (1.19MB).

* Margin points.

|

| Billings1 |

£46,186m |

£46,209m |

– |

| Revenue |

£11,529m |

£11,019m |

+4.6 |

| Net sales1 |

£10,065m |

£10,076m |

-0.1 |

| Headline EBITDA2 |

£1,910m |

£1,896m |

+0.7 |

| Headline operating profit2 |

£1,611m |

£1,583m |

+1.8 |

| Reported operating profit |

£1,507m |

£1,410m |

+6.9 |

| Headline PBIT2 |

£1,681m |

£1,662m |

+1.1 |

| Net sales margin2 |

16.7% |

16.5% |

+0.2* |

| Headline PBT2 |

£1,513m |

£1,458m |

+3.7 |

| Reported PBT |

£1,452m |

£1,296m |

+12.0 |

| Headline earnings2 |

£1,136m |

£1,088m |

+4.4 |

| Reported earnings |

£1,077m |

£937m |

+15.0 |

| |

|

|

|

|

Headline diluted earnings per share 2,4

|

84.9p

|

80.8p

|

+5.1

|

|

Reported diluted earnings per share 4

|

80.5p

|

69.6p

|

+15.7

|

|

Ordinary dividend per share

|

38.20p

|

34.21p

|

+11.7

|

|

Ordinary dividend per ADR 3

|

$3.15

|

$2.68

|

+17.5

|

| |

|

|

|

|

Net debt at year-end

|

£2,275m

|

£2,240m

|

+1.6

|

|

Average net debt5

|

£3,001m

|

£2,989m

|

+0.4

|

|

Ordinary share price at year-end

|

1,345.0p

|

1,380.0p

|

-2.5

|

|

ADR price at year-end

|

$104.10

|

$114.86

|

-9.4

|

|

Market capitalisation at year-end

|

£17,831m

|

£18,613m

|

-4.2

|

| |

|

|

|

|

At 17 April 2015

|

|

|

|

|

Ordinary share price

|

1,543.0p

|

|

|

|

ADR price

|

$115.44

|

|

|

|

Market capitalisation

|

£20,456m

|

|

|

Revenue £m

Reported revenue was up 4.6% at £11,529 million. On a constant currency basis, revenue was up 11.3% and, on a like-for-like basis, revenue was up 8.2%.

Net sales £m

Reported net sales were almost flat on 2013 at £10,065 million. On a constant currency basis, net sales were up 6.3% and, on a like-for-like basis, net sales were up 3.3%.

Headline PBIT1 £m

Headline PBIT was up 1.1% to £1,681 million. Net sales margin was up 0.2 margin points (0.3 margin points on a constant currency basis) to an industry-leading 16.7%.

Headline EBITDA1 £m

Headline EBITDA (headline earnings before interest, taxation, depreciation and amortisation) rose by 0.7% (7.5% in constant currencies), reflecting currency headwinds.

Return on equity2 %

- Weighted average cost of capital (WACC)

15.0%

Return on equity increased to 15.0% in 2014, while the weighted average cost of capital fell to 6.1%.

Headline diluted earnings per share1 p

Headline diluted earnings per share up 5.1% to 84.9p. Dividends were up 11.7% to 38.20p per share.

Average net debt £m

- Average net debt to headline EBITDA2 ratio

3,001m

Average net debt was flat at £3.0 billion in 2014. The average net debt to headline EBITDA ratio remained at 1.6 times, at the low end of the Group’s target range of 1.5-2.0 times.

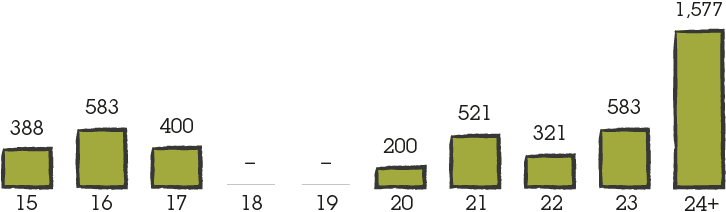

Debt maturity3 £m

The Group continues to work to achieve continuity and flexibility of funding. Undrawn committed borrowing facilities are maintained in excess of peak net-borrowing levels and debt maturities are monitored closely.

2014 revenue by geography %

- North America34

- UK14

- Western Continental Europe22

- Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe30

In 2014, 30% of the Group’s revenue came from Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe. Our target is to increase this to 40-45% of revenues over the next five years.

2014 headline PBIT1 by geography %

- North America37

- UK13

- Western Continental Europe17

- Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe33

Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe now account for one-third of the Group’s headline PBIT and have profit margins of over 18%.

2014 revenue by sector %

- Advertising and Media Investment Management44

- Data Investment Management21

- Public Relations & Public Affairs8

- Branding & Identity, Healthcare and Specialist Communications27

Marketing services comprised 56% of our revenues in 2014, a little less than 2013. Revenue growth was strongest in Advertising and Media Investment Management at almost 20% in constant currencies.

2014 headline PBIT1 by sector %

- Advertising and Media Investment Management50

- Data Investment Management16

- Public Relations & Public Affairs8

- Branding & Identity, Healthcare and Specialist Communications26

PBIT contributions were broadly in line with revenues, with Data Investment Management and Public Relations & Public Affairs showing significant margin growth.